In 2025, selecting the right B2B payment services is crucial for your business’s smooth operation, growth, and security. Understanding the importance of B2B payment services can significantly influence your decision-making process and ensure your business stays competitive.

Why You Need B2B Payment Services

Streamlined Operations

- Automate Payments: B2B payment services automate the payment process, reducing manual efforts and minimizing errors.

- Easy Integration: These services seamlessly integrate with existing accounting software, simplifying your financial management.

Improved Cash Flow

- Quick Transactions: B2B payment services ensure faster transaction processing, leading to quicker access to funds.

- Predictable Payments: They provide predictable payment timelines, which is essential for financial planning.

Enhanced Security

- Safe Transactions: B2B payment services offer advanced security features to protect against fraud and data breaches.

- Stay Compliant: Compliance with financial regulations is easier with B2B payment services, offering peace of mind.

Top 6 B2B Payment Services: Ranked and Reviewed

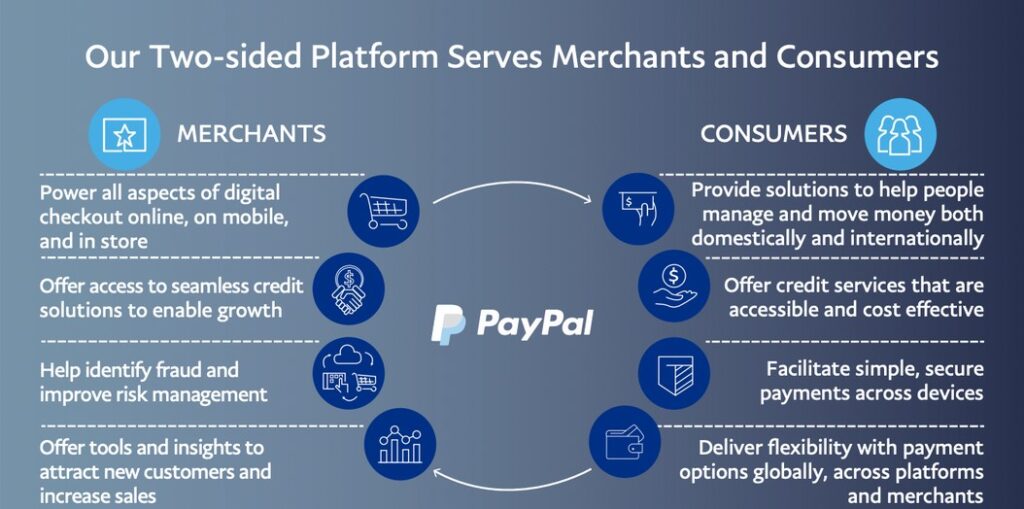

1. PayPal Business

PayPal Business stands tall as a leading figure in the payment processing industry, catering specifically to the needs of businesses. As a premier B2B payment service, it offers invoicing, payment processing, and handling international payments, making it an ideal choice for businesses looking to streamline their financial operations.

Key Features to Look For

When considering PayPal Business for your B2B payment service needs, here are the key features to keep an eye out for:

- User-Friendliness: An intuitive interface is crucial for efficient payment management in any B2B payment service.

- Payment Processing Speed: Fast transactions are vital for improving cash flow in the B2B payment service sector.

- Security Measures: Robust security features are non-negotiable to protect your transactions in a B2B payment service.

- Integration Ease: Compatibility with existing business systems is essential for seamless operations in B2B payment services.

Comparing Costs of PayPal Business’s fee Services

Understanding PayPal Business’s fee structure is crucial in the context of B2B payment services:

- Transaction Fees: Typically involves a percentage of the transaction amount plus a fixed fee, a common practice in B2B payment services.

- Monthly Fees: Depending on your specific needs, some B2B payment services, including PayPal Business, may require a monthly subscription.

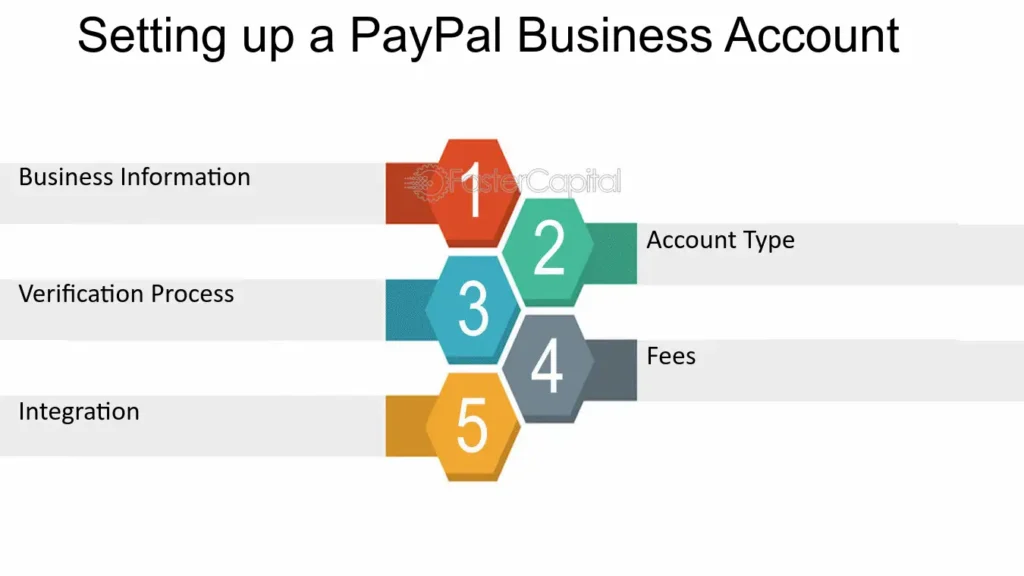

How to Get Started with PayPal Business

Getting started with PayPal Business, a leading B2B payment service, is straightforward:

- Sign Up: Create a PayPal Business account.

- Set Up: Configure your account settings and preferences tailored to B2B payment service requirements.

- Begin Processing Payments: Start sending invoices and processing payments immediately, leveraging the benefits of a streamlined B2B payment service.

“Get started with PayPal Business today,”

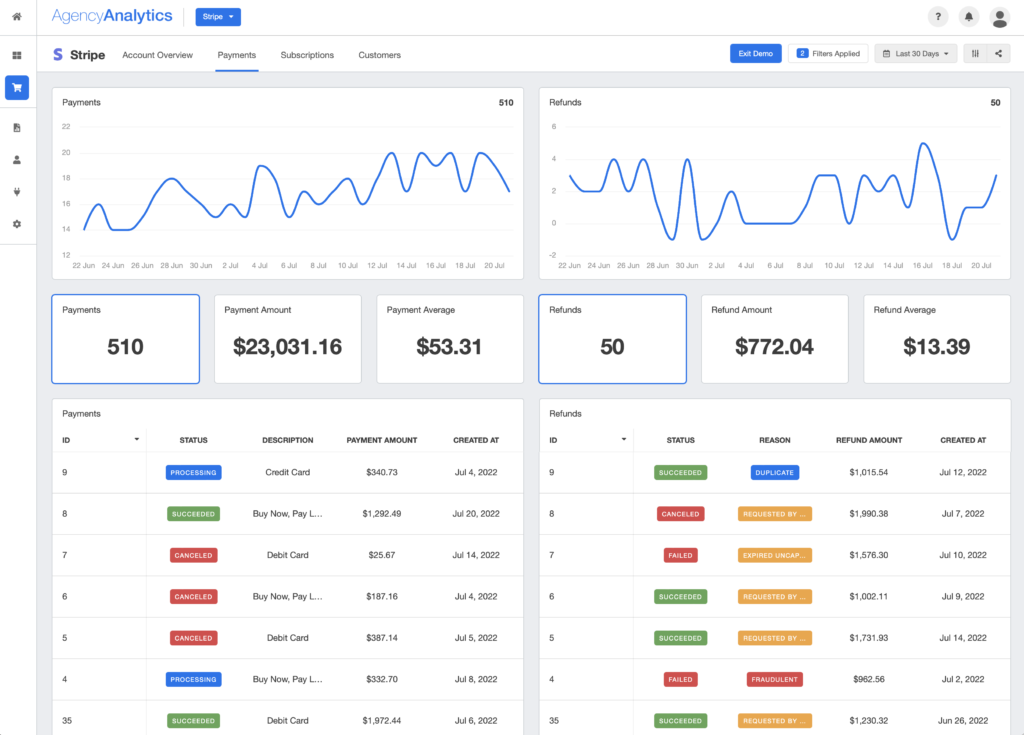

2. Stripe

Stripe stands out in the digital payment processing landscape, especially for online businesses that prioritize flexibility and integration capabilities.

As a leading B2B payment service, Stripe offers a robust suite of tools designed to accommodate the complex needs of modern businesses, including developer-friendly APIs, payment processing, and more.

Key Features to Look For

Stripe’s offering as a B2B payment service comes with several key features that stand out:

- Developer-Friendly APIs: Stripe’s API-first approach ensures that integrating payment processing into your online business is as smooth as possible.

- Comprehensive Payment Processing: From card payments to alternative methods, Stripe’s B2B payment service caters to a wide range of transaction types.

- Advanced Security Measures: Stripe places a high priority on security, offering advanced features to protect your online transactions within the B2B payment service framework.

- Global Payment Solutions: Stripe supports international payments, making it an ideal B2B payment service for businesses looking to expand globally.

Comparing Costs of Stripe Payment Services

When evaluating Stripe as your B2B payment service provider, consider the following cost structure:

- Transaction Fees: Stripe’s transparent pricing typically includes a per-transaction fee, which is standard across B2B payment services.

- No Hidden Fees: Stripe prides itself on its straightforward pricing model, with no hidden fees—a critical factor for businesses planning their finances.

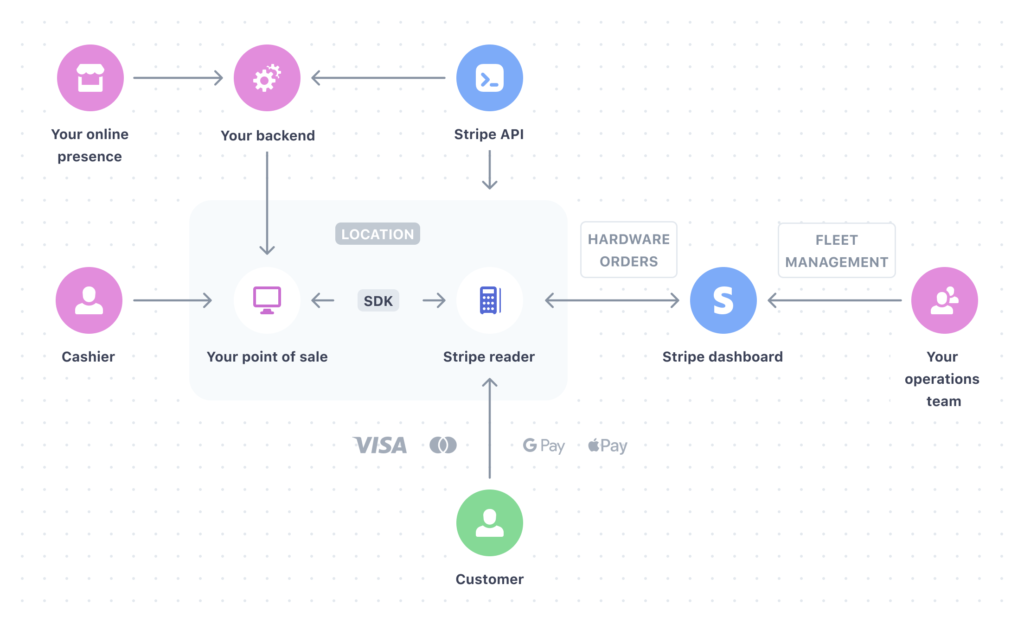

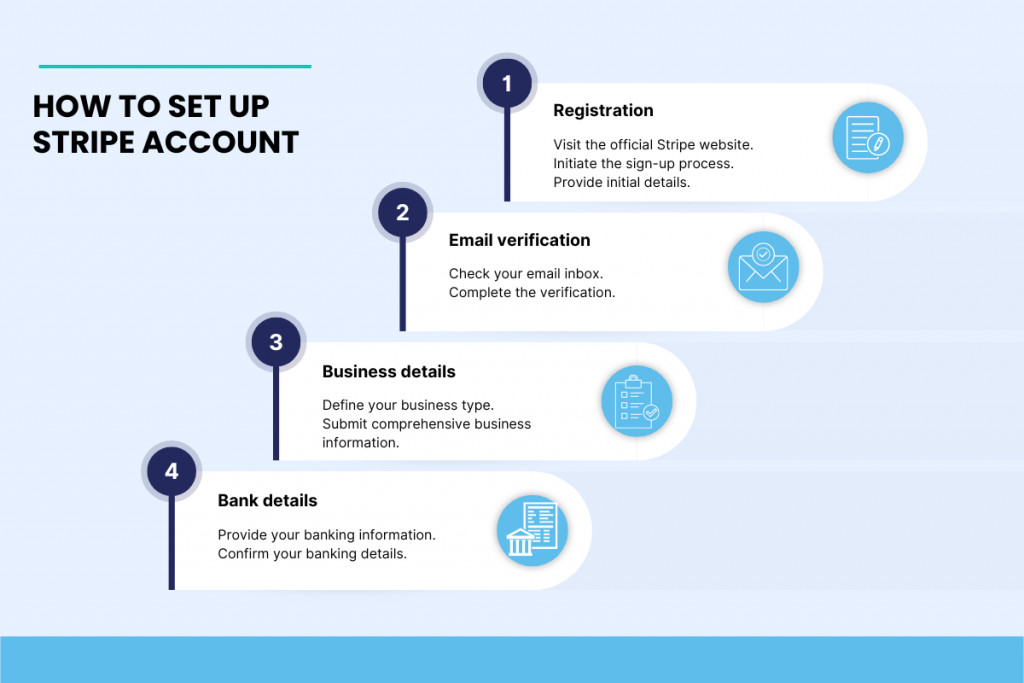

How to Get Started with Stripe B2B Payment Service

Embarking on your journey with Stripe, a comprehensive B2B payment service, involves a few simple steps:

- Sign Up: Register for a Stripe account tailored to your business needs.

- Integration: Utilize Stripe’s developer-friendly APIs to integrate payment processing into your online platform.

- Begin Processing Payments: Start accepting payments globally with Stripe’s versatile payment solutions.

“Discover how Stripe can transform your online payment processing today,

3. Square

Square is a pivotal player in the payment processing domain, offering an array of solutions specifically designed for small to medium-sized businesses (SMBs). As a top-tier B2B payment service, Square provides comprehensive tools including point of sale (POS) systems, online payments, and invoice payment capabilities, making it an invaluable asset for SMBs aiming to optimize their transaction processes.

The Square Affiliate Program further complements its offerings, rewarding partners for bringing new customers into the Square ecosystem.

Key Features to Look For

Square’s prowess as a B2B payment service is evident through its diverse range of features:

- Point of Sale Systems: Square’s POS systems are renowned for their ease of use and versatility, catering to a variety of business types.

- Online Payment Processing: Square enables SMBs to accept online payments effortlessly, making it a cornerstone for e-commerce within the B2B payment service sphere.

- Invoice Payment Solutions: Square simplifies invoicing and payment collection, streamlining cash flow for businesses.

- Comprehensive Security: Offering robust security measures, Square ensures that transactions are secure, a must-have in any B2B payment service.

Comparing Costs of Square Payment Services

Understanding the cost implications of adopting Square as your B2B payment service provider is crucial:

- Transparent Pricing: Square is known for its clear, upfront pricing structure, including per-transaction fees without hidden costs.

- Versatile Plans: Depending on your business size and needs, Square offers various pricing plans to suit different operational scales.

“Transform your business with Square today,”

How to Get Started with Square B2B Payment Service

Launching your business’s payment processing with Square involves a few straightforward steps:

- Sign Up: Register with Square and choose the services that best fit your business’s needs.

- Equipment Setup: For physical stores, set up Square’s POS system; for online sales, integrate Square’s payment gateway on your website.

- Begin Processing Payments: Start accepting payments in-person and online, leveraging Square’s seamless payment solutions.

“Transform your business with Square today,”

“Transform your business with Square today,”

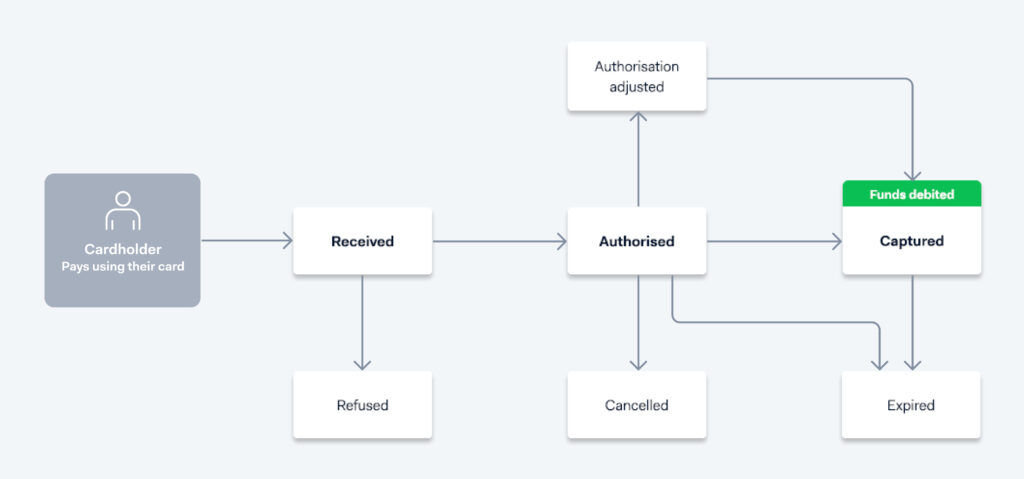

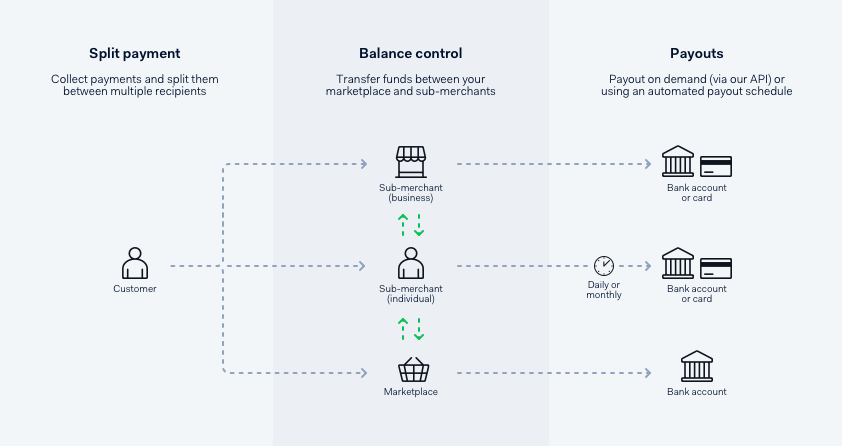

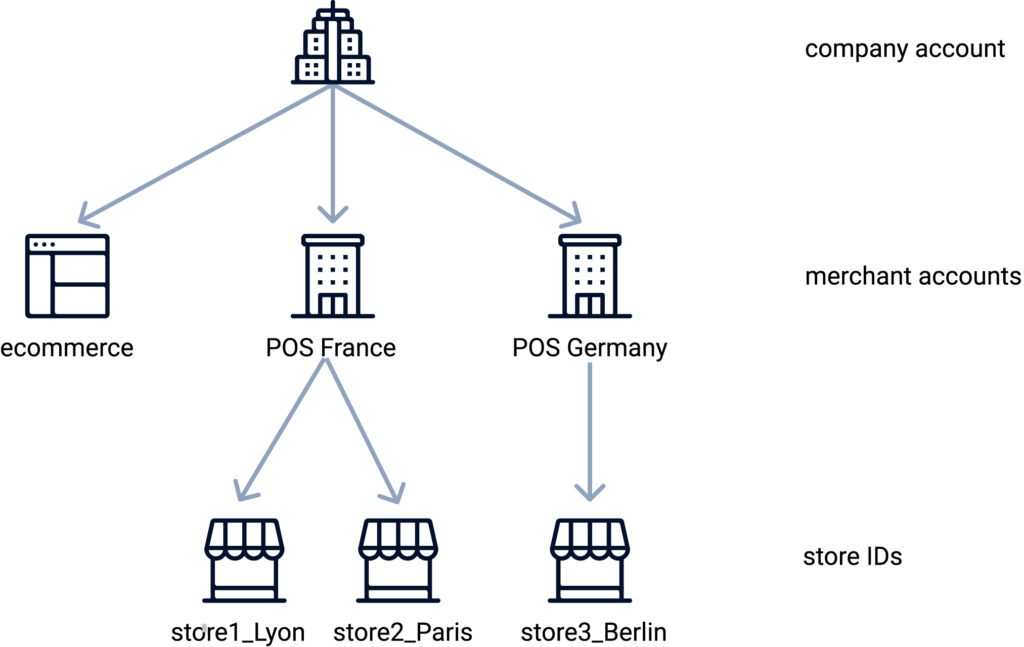

4. Adyen

Adyen emerges as a powerful force in the global payment processing landscape, catering to businesses of all sizes with a focus on large enterprises. This B2B payment service excels by offering a holistic platform that encompasses the entire payment flow, including gateway services, risk management, and processing capabilities.

Although Adyen’s comprehensive solutions are widely recognized, details on its affiliate program tend to be more nuanced, likely tailored to partners within the financial services sector.

Key Features to Look For

Adyen distinguishes itself in the B2B payment service market with several standout features:

“Explore Adyen’s global payment solutions”

- End-to-End Payment Solutions: Adyen provides a unified platform for gateway, processing, and risk management, simplifying the payment flow for businesses.

- Global Payment Acceptance: With Adyen, businesses can accept payments from anywhere in the world, making it an ideal B2B payment service for companies with a global customer base.

- Advanced Risk Management: Adyen’s sophisticated risk management tools help protect businesses from fraud and unauthorized transactions.

- Seamless Integration: The platform is designed for easy integration with existing business systems, ensuring a smooth payment experience.

Comparing Costs of Adyen Payment Services

When considering Adyen for your business, it’s important to evaluate its cost structure:

- Custom Pricing: Adyen offers tailored pricing based on the business’s specific needs and transaction volumes, highlighting its flexibility as a B2B payment service.

- Transparent Fee Structure: Despite the custom pricing, Adyen maintains transparency in its fees, including transaction and service charges, which is crucial for businesses to plan their expenses effectively.

How to Get Started with Adyen

Implementing Adyen as your business’s payment processing solution involves a few key steps:

- Inquiry and Consultation: Reach out to Adyen to discuss your business needs and understand how their B2B payment service can be tailored for you.

- Integration: Utilize Adyen’s integration guides and support to seamlessly add their payment processing capabilities to your business operations.

- Start Processing Payments: With everything in place, you can begin accepting global payments securely and efficiently.

“Explore Adyen’s global payment solutions,”

5. Wise for Business

Wise for Business, formerly known as TransferWise, has redefined the B2B payment service landscape with its innovative borderless banking solutions. Tailored for businesses that operate on a global scale, Wise for Business facilitates the easy sending, receiving, and management of funds in multiple currencies.

Its affiliate program is particularly attractive for those catering to an international audience, offering a unique opportunity to benefit from promoting Wise’s extensive suite of financial services.

Key Features to Look For

Wise for Business stands out in the B2B payment service sector with features designed to support international commerce:

- Multi-Currency Transactions: Allows businesses to send and receive payments in numerous currencies, simplifying global transactions.

- Competitive Exchange Rates: Wise for Business offers real exchange rates, helping businesses save money on international transfers.

- Transparent Fees: The platform is known for its upfront fee structure, ensuring businesses understand the costs of their transactions.

- Ease of Use: Wise for Business prides itself on a user-friendly interface, making it straightforward to manage international payments.

“Join Wise for Business and simplify your global financial operations today,”

Comparing Costs of Wise for Business Payment Services

Evaluating Wise for Business as your go-to B2B payment service involves understanding its cost benefits:

- Low Transaction Fees: Wise charges minimal fees for international transfers, often making it more cost-effective than traditional banks.

- No Hidden Costs: The commitment to transparency means businesses can plan their finances without worrying about unexpected charges.

How to Get Started with Wise for Business

Adopting Wise for Business for your international payment needs is a straightforward process:

- Sign Up: Create a Wise for Business account to start leveraging its borderless banking solutions.

- Verification: Complete the necessary verification steps to ensure the security and compliance of your account.

- Integration: Integrate Wise for Business into your financial operations, taking advantage of tools like batch payments and API access for automation.

- Start Managing Money: Begin sending, receiving, and managing funds in multiple currencies with ease.

“Join Wise for Business and simplify your global financial operations today,”

6. Zelle

Zelle, widely recognized for its peer-to-peer payment functionality, extends its services to the business sector, offering streamlined solutions for companies to efficiently send and receive payments.

As Zelle integrates directly with numerous banking applications, its approach to B2B payment services is notably direct and seamless.

The nature of Zelle’s integration into existing banking platforms means the availability and structure of an affiliate program may differ, presenting a more indirect route for affiliate opportunities compared to standalone payment platforms.

Key Features to Look For

Zelle’s offering in the B2B payment service landscape is characterized by key features that cater to the needs of businesses looking for quick and reliable payment solutions:

- Instant Payments: Zelle facilitates immediate transactions, allowing businesses to send and receive payments in real-time.

- Bank-Level Security: Leveraging the security measures of integrated banking apps, Zelle provides a secure platform for business transactions.

- Wide Availability: With direct integration in many banking apps, Zelle is readily accessible for businesses using participating banks.

- Ease of Use: Zelle’s user-friendly interface, familiar to many through personal banking apps, makes business transactions straightforward.

Comparing Costs of Zelle Payment Services

When considering Zelle for your business’s payment needs, it’s important to note:

- No Direct Fees: Zelle typically does not charge fees for sending or receiving money, making it a cost-effective option for businesses.

- Bank-Specific Policies: While Zelle itself may not impose fees, it’s crucial to check for any associated fees from your bank or financial institution.

xplore a recommended financial management tool that integrates well with Zelle

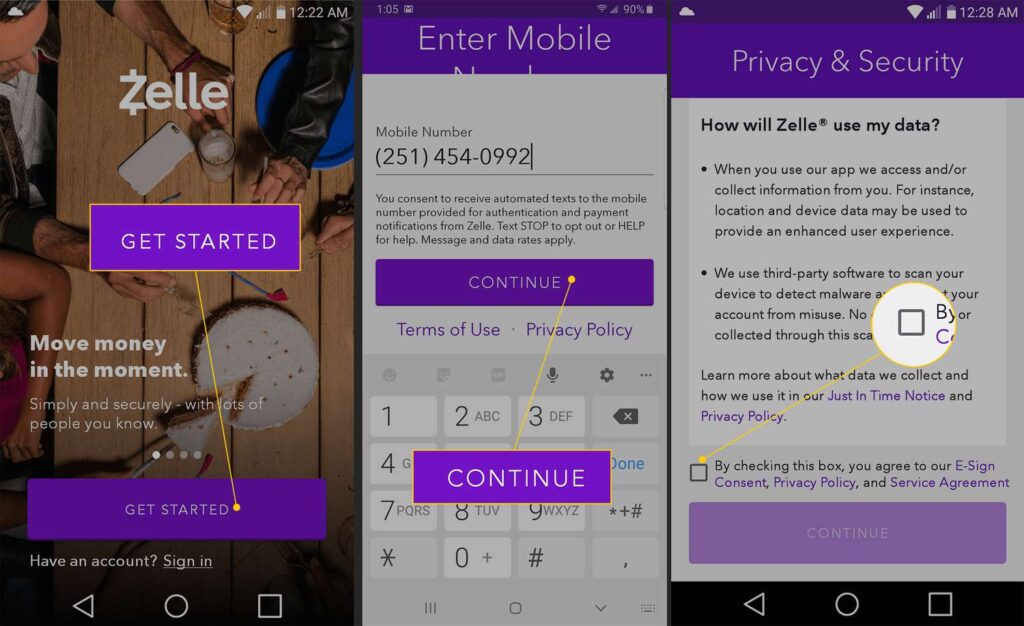

How to Get Started with Zelle

Implementing Zelle for business payments involves a few straightforward steps:

- Check Eligibility: Ensure your business bank account is with a Zelle-participating bank.

- Enroll with Zelle: Use your banking app or contact your bank to activate Zelle for your business account.

- Start Transacting: Begin sending and receiving payments instantly through your existing banking app, integrated with Zelle.

Explore a recommended financial management tool that integrates well with Zelle

Evaluating Service and Support

When selecting a B2B payment service, the caliber of customer support and service availability can significantly impact your business operations.

Here’s why reliable customer support is paramount:

- 24/7 Availability: Access to support around the clock ensures that any payment issues can be resolved promptly, minimizing downtime.

- Multiple Support Channels: The availability of various channels (phone, email, live chat) allows you to seek help in the way that best suits your needs.

- Knowledgeable Support Team: A team well-versed in troubleshooting and the specifics of payment processing can provide quick and effective solutions.

- Resource Availability: Access to extensive online resources, such as tutorials and FAQs, empowers users to find answers quickly and independently.

Assessing Mobile and Remote Access Capabilities

In today’s fast-paced business environment, the ability to manage payments on the go is crucial. Here’s why mobile and remote access capabilities are key factors to consider:

- Convenience: Manage payments from anywhere, whether you’re out of the office or on the move, enhancing operational flexibility.

- Real-Time Management: Immediate access to your payment system allows for real-time transaction monitoring and management.

- Security: Secure mobile access ensures that you can safely manage payments without compromising sensitive information.

- User Experience: A user-friendly mobile interface can significantly enhance the efficiency of managing transactions and accounts remotely.

Real User Reviews and Success Stories

Dive into the firsthand experiences of current users to grasp the tangible impacts and satisfaction levels of integrating a B2B payment service into their operations. These stories not only showcase the diverse applications of such services but also highlight the real-world benefits companies are enjoying.

- Enhanced Efficiency: “Switching to a B2B payment service streamlined our invoicing process, cutting down payment times from weeks to just a few days,” shares a small business owner.

- Improved Cash Flow: A finance manager reports, “Our cash flow management has improved significantly, thanks to the real-time processing capabilities of our chosen B2B payment service.”

- Robust Security: “We’ve experienced a noticeable reduction in fraud and unauthorized transactions since implementing our new payment service,” notes a cybersecurity officer.

- Customer Satisfaction: “Our clients appreciate the flexibility and ease of payment options we now offer, leading to higher satisfaction rates,” explains a customer service director.

Making Your Decision

Selecting a B2B payment service that not only meets your current needs but also scales with your business growth is crucial. Here are some final thoughts to consider:

- Scalability: Ensure the service can handle your growing transaction volumes and business expansion.

- Integration: Look for services that easily integrate with your existing business systems for a seamless operation.

- Support: Prioritize services with robust customer support to address any issues swiftly.

- Cost-Effectiveness: Evaluate the fee structure to ensure it aligns with your budget and offers value for money.

Conclusion

Choosing the right B2B payment service is more than just a financial decision; it’s a strategic move that can revolutionize how your business operates in 2025. The right service will not only streamline operations but also enhance cash flow, improve security, and elevate customer satisfaction.

As the business landscape continues to evolve, embracing a suitable B2B payment service is essential for staying competitive and fostering growth.

FAQ Section for B2B Payment Services

Q1: What are B2B payment services?

A1: B2B payment services are specialized platforms designed to facilitate transactions between businesses. These services streamline the process of sending and receiving payments, manage invoices, and often provide additional features like fraud protection, reporting tools, and integration with accounting software.

Q2: Why are B2B payment services important for my business?

A2: B2B payment services are crucial for improving operational efficiency, enhancing cash flow management, and ensuring secure transactions. They simplify the payment process, reduce processing times, and offer robust security measures to protect your business from fraud.

Q3: How do I choose the right B2B payment service?

A3: When choosing a B2B payment service, consider factors such as transaction fees, payment processing speed, security measures, ease of integration with your existing systems, and the level of customer support provided. Assessing your business needs and comparing them against what each service offers is key to making the right choice.

Q4: Can B2B payment services integrate with my existing accounting software?

A4: Many B2B payment services offer integration capabilities with popular accounting software. This integration helps streamline your financial processes, ensuring seamless transaction recording and reporting.

Q5: Are B2B payment services secure?

A5: Security is a top priority for B2B payment services. These platforms employ various security measures, including encryption, fraud detection algorithms, and compliance with industry standards like PCI DSS, to protect sensitive information and ensure the secure processing of transactions.