Blockchain Financial Transformation is a revolutionary force reshaping the financial industry by introducing enhanced transparency, security, and efficiency.

In 2025, this transformation is more critical than ever as financial institutions seek to innovate and stay competitive.

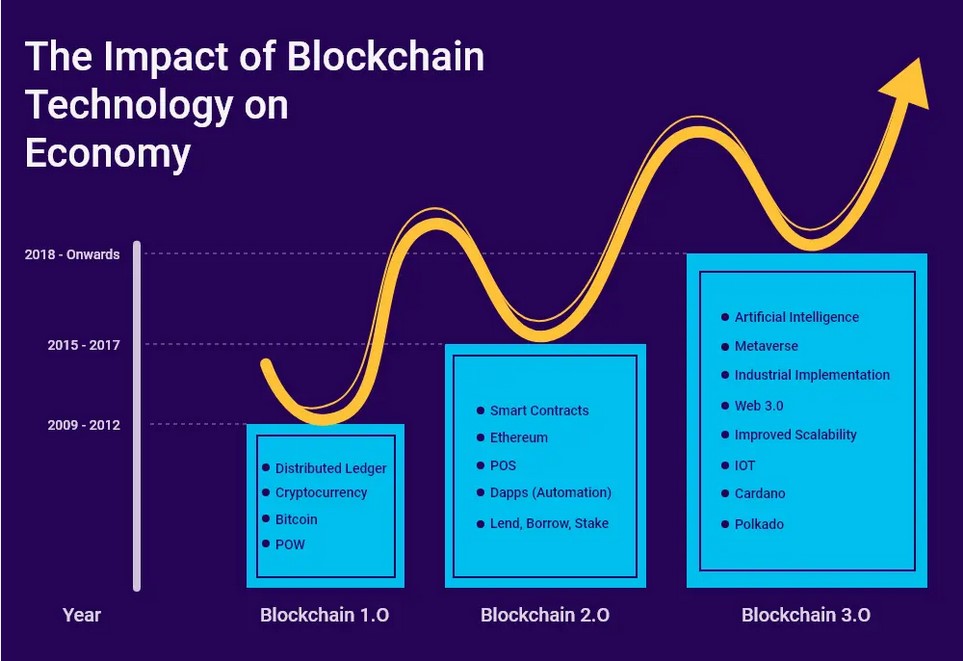

Blockchain technology, once synonymous with cryptocurrencies, has evolved into a multifaceted tool with vast applications across the financial sector.

Verdict: Blockchain Financial Transformation is not just a technological advancement but a crucial evolution in finance, driving unprecedented efficiency, security, and transparency.

Core Components of Blockchain Financial Transformation

Blockchain Financial Transformation hinges on several core components that distinguish it from traditional financial systems.

These components include decentralization, smart contracts, and cryptography, each playing a vital role in enhancing the functionality and security of financial operations.

1. Decentralization

Decentralization is at the heart of Blockchain Financial Transformation.

Unlike traditional financial systems that rely on centralized authorities, blockchain operates on a decentralized network of nodes.

This structure eliminates the need for intermediaries, reducing transaction costs and increasing the speed of financial operations.

Decentralization also enhances transparency, as all transactions are recorded on a public ledger accessible to all participants.

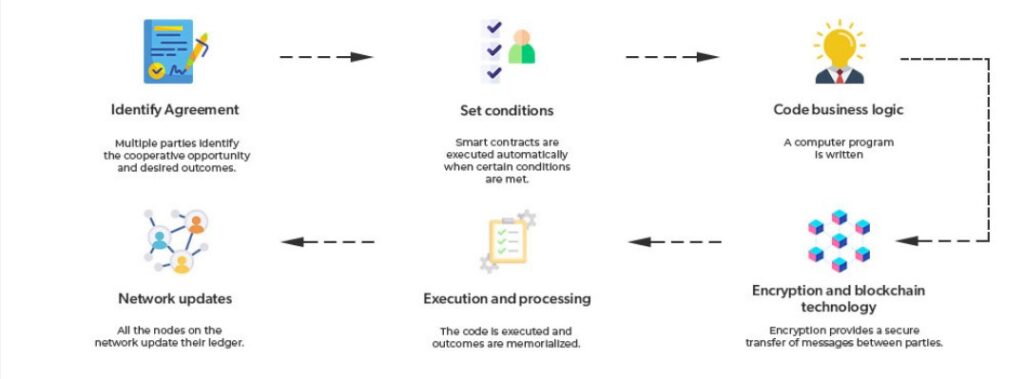

2. Smart Contracts

Smart contracts are self-executing contracts where the terms of the agreement are directly written into code.

These contracts automatically execute transactions when predefined conditions are met, eliminating the need for third-party intermediaries.

In the context of Blockchain Financial Transformation, smart contracts ensure that transactions are secure, efficient, and free from human error.

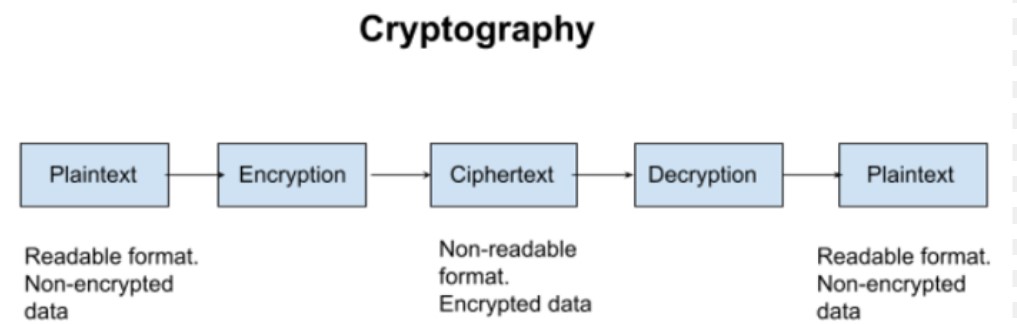

3. Cryptography and Security

Cryptography is a foundational element of blockchain technology, providing the security necessary to protect sensitive financial information.

Blockchain uses advanced cryptographic techniques to secure data, ensuring that only authorized parties can access and modify transaction records.

This high level of security is crucial for maintaining trust in digital financial transactions.

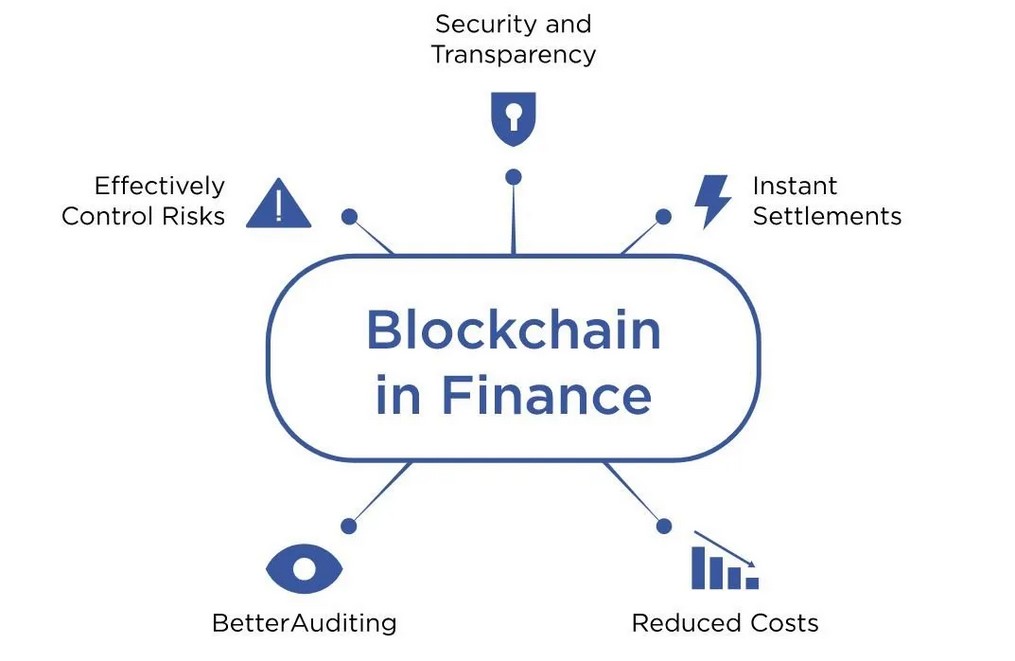

Key Benefits of Blockchain Financial Transformation

Blockchain Financial Transformation offers numerous benefits that make it an attractive option for financial institutions.

These benefits include increased transparency, cost reduction, and significant efficiency gains.

1. Transparency

Blockchain technology improves transparency in financial operations by providing a public ledger where all transactions are recorded.

This transparency allows for easier tracking and auditing of financial activities, reducing the potential for fraud and enhancing trust among participants.

2. Cost Reduction

One of the most significant advantages of Blockchain Financial Transformation is the reduction in operational costs. By eliminating intermediaries and streamlining processes, blockchain reduces the overhead associated with traditional financial transactions. This cost efficiency is passed on to businesses and consumers, making financial services more affordable.

3. Efficiency Gains

Blockchain technology streamlines financial processes, reducing the time required for transaction settlement.

By automating these processes through smart contracts, blockchain increases the speed and efficiency of financial operations, enabling faster and more reliable transactions.

Top Blockchain Platforms in Finance:

Why Ethereum, Hyperledger, and Ripple Are Leading the Charge in 2025

In today’s rapidly evolving financial landscape, blockchain technology has become a game-changer.

As more businesses and financial institutions adopt this technology, choosing the right blockchain platform is crucial for success.

Whether you’re interested in developing decentralized applications, optimizing enterprise-level operations, or streamlining cross-border payments, selecting the right platform can significantly impact your business.

In this article, we’ll explore three of the top blockchain platforms—Ethereum, Hyperledger, and Ripple—and explain why they’re leading the charge in Blockchain Financial Transformation.

1. Ethereum: The Powerhouse for Decentralized Applications (DApps)

What is Ethereum?

Ethereum is one of the most widely recognized and adopted blockchain platforms, especially known for its innovative smart contract capabilities.

Launched in 2015, Ethereum allows developers to build decentralized applications (DApps) that run on a secure and decentralized network.

These DApps can automate and secure complex financial transactions, making Ethereum a cornerstone of Blockchain Financial Transformation.

Why Ethereum Stands Out

Ethereum’s most significant feature is its smart contracts—self-executing contracts where the terms of the agreement are directly written into code.

This automation eliminates the need for intermediaries, reducing costs and minimizing the risk of human error. For financial institutions, this translates into more efficient, secure, and cost-effective transactions.

Another reason Ethereum is a go-to platform is its active and robust ecosystem.

Thousands of developers contribute to its continuous improvement, ensuring it remains at the cutting edge of blockchain technology.

This makes Ethereum a versatile choice for businesses looking to innovate and stay ahead in the competitive financial market.

Key Features of Ethereum

- Smart Contracts: Automate complex transactions without the need for intermediaries.

- DApps: Build decentralized applications that operate securely on a global scale.

- Scalability: Ethereum 2.0 and Layer 2 solutions address scalability issues, enabling more transactions at lower costs.

- Interoperability: Works well with other blockchain networks, making it highly versatile.

Use Cases in Finance

- Decentralized Finance (DeFi): Enabling peer-to-peer financial services like lending and trading without intermediaries.

- Tokenization of Assets: Creating digital tokens that represent real-world assets, increasing liquidity and accessibility.

- Smart Contract Audits: Ensuring the accuracy and security of financial contracts through immutable code.

2. Hyperledger: The Backbone for Enterprise-Level Blockchain Solutions

What is Hyperledger?

Hyperledger is an open-source blockchain initiative hosted by The Linux Foundation, specifically designed to support the development of blockchain solutions for businesses.

Unlike public blockchains like Ethereum, Hyperledger operates on a permissioned network, where participants must be authorized to join. This makes Hyperledger particularly appealing for enterprise-level applications that require high levels of privacy, security, and control.

Why Hyperledger is Ideal for Enterprises

One of Hyperledger’s standout features is its modular architecture, which allows businesses to customize their blockchain networks according to their specific needs.

Whether it’s managing complex supply chains, ensuring data privacy, or meeting regulatory requirements, Hyperledger provides the flexibility and scalability necessary for large-scale operations.

Security and scalability are at the forefront of Hyperledger’s design. It’s built to handle a high volume of transactions without compromising on security, making it an ideal platform for financial institutions that need to process large numbers of transactions quickly and securely.

Key Features of Hyperledger

- Permissioned Networks: Only authorized participants can access the network, ensuring enhanced privacy and security.

- Modular Architecture: Customizable networks tailored to specific business and regulatory needs.

- Scalability: Handles high transaction volumes, ideal for large enterprises.

- Interoperability: Seamless integration with existing systems across various industries.

Use Cases in Finance

- Supply Chain Finance: Streamlining and securing processes from procurement to payment.

- Trade Finance: Facilitating secure and transparent global trade transactions.

- Regulatory Compliance: Ensuring transactions comply with complex regulations through a secure and auditable blockchain network.

3. Ripple: The Solution for Real-Time Cross-Border Payments

What is Ripple?

Ripple is a blockchain platform specifically designed to facilitate real-time, cross-border payment solutions.

Since its launch in 2012, Ripple has partnered with numerous financial institutions to enable faster, cheaper, and more reliable international transactions.

Its native cryptocurrency, XRP, is used to provide liquidity during transactions, reducing the need for pre-funded accounts.

Why Ripple is a Game-Changer

Ripple’s ability to process cross-border payments in real-time is one of its most compelling features.

Traditional cross-border payments can take days to settle and incur high fees due to the involvement of multiple intermediaries.

Ripple eliminates these inefficiencies by enabling instant settlement at a fraction of the cost, making it a preferred choice for financial institutions operating globally.

Ripple’s expanding network of partners is another strong reason to consider this platform.

By collaborating with leading financial institutions worldwide, Ripple ensures that its technology is reliable, widely accepted, and continuously improving.

Key Features of Ripple

- Real-Time Settlement: Instantly processes cross-border payments, reducing settlement times from days to seconds.

- Low Transaction Costs: Significantly lower fees compared to traditional international payment systems.

- Liquidity Through XRP: XRP serves as a bridge currency, facilitating liquidity and minimizing the need for pre-funded accounts.

- Interoperability: Easily integrates with existing financial systems, making adoption straightforward for institutions.

Use Cases in Finance

- International Remittances: Enabling fast, cost-effective remittances for individuals and businesses worldwide.

- Corporate Payments: Streamlining large-scale payments for multinational corporations, reducing costs and settlement times.

- Bank-to-Bank Transfers: Facilitating secure, real-time transactions between banks, enhancing efficiency and reducing operational costs.

Major Applications of Blockchain in Finance

The application of blockchain technology in finance is vast and continues to grow.

Key areas where Blockchain Financial Transformation is making a significant impact include cross-border payments, asset tokenization, and supply chain finance.

Cross-Border Payments

Blockchain simplifies cross-border payments by providing a decentralized platform that reduces transaction costs and speeds up the process.

Traditional international payments often involve multiple intermediaries, each adding time and cost to the transaction. Blockchain eliminates these intermediaries, allowing for faster, more cost-effective international transactions.

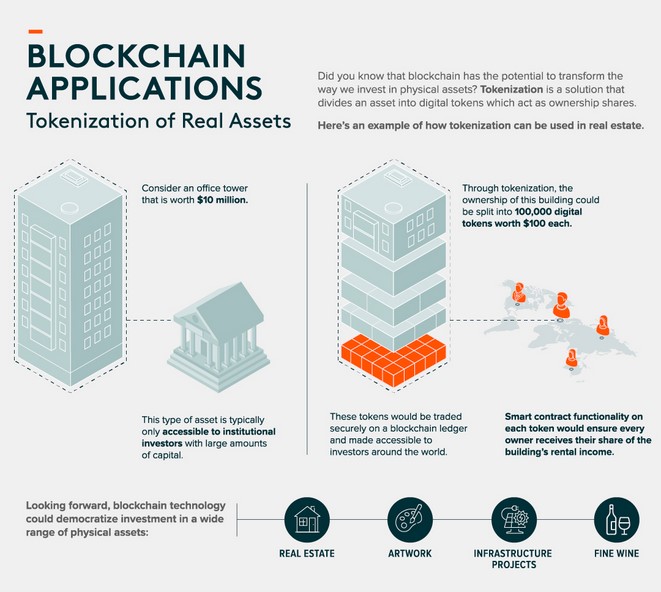

Asset Tokenization

Asset tokenization is the process of converting physical assets into digital tokens on a blockchain.

This application of Blockchain Financial Transformation enhances the liquidity of traditionally liquid assets, such as real estate or fine art.

Tokenization also enables fractional ownership, allowing investors to buy and sell portions of assets rather than the entire asset, increasing accessibility and market participation.

Supply Chain Finance

Blockchain technology improves supply chain finance by providing real-time tracking of goods and payments.

This transparency ensures that all parties in the supply chain are informed and that payments are made promptly, reducing the risk of fraud and disputes.

Blockchain’s immutable ledger also provides a single source of truth, which is critical for verifying the authenticity and origin of goods.

Challenges in Implementing Blockchain Financial Transformation

Despite its numerous advantages, Blockchain Financial Transformation is not without challenges.

Financial institutions must navigate regulatory hurdles, integrate blockchain with legacy systems, and address scalability issues.

1. Regulatory Hurdles

Regulation is one of the most significant challenges facing Blockchain Financial Transformation.

Different countries have varying levels of regulatory acceptance, with some embracing blockchain technology and others imposing strict regulations that limit its use.

Financial institutions must ensure compliance with these regulations, which can be complex and costly.

2. Integration with Legacy Systems

Many financial institutions rely on legacy systems that were not designed to work with blockchain technology.

Integrating Blockchain Financial Transformation with these existing systems can be challenging, requiring significant investment in technology and expertise.

The risk of disruption to existing operations is also a concern that must be carefully managed.

3. Scalability Issues

As the adoption of blockchain technology grows, so too does the need for scalable solutions that can handle increasing transaction volumes.

Blockchain’s current scalability limitations can result in slower transaction times and higher costs as network usage increases.

Addressing these scalability issues is essential for the widespread adoption of Blockchain Financial Transformation.

Case Studies

Real-world examples of Blockchain Financial Transformation illustrate its potential and provide valuable lessons for other financial institutions considering adoption.

Successful Implementations

JPMorgan’s Quorum platform is a prime example of successful Blockchain Financial Transformation. Quorum, a permissioned version of Ethereum, has been used to streamline payments and reduce settlement times.

The platform’s ability to handle high transaction volumes while maintaining security and transparency has made it a valuable tool for the bank.

Lessons Learned

These successful implementations highlight the importance of regulatory compliance and the need for robust security measures.

Financial institutions must also be prepared to invest in the necessary technology and expertise to support blockchain integration.

The experiences of early adopters provide valuable insights that can guide others in their blockchain journey.

Future Prospects and Predictions

The future of Blockchain Financial Transformation is bright, with continued innovation and adoption expected across the financial industry.

Key areas of focus include the growth of blockchain in FinTech, the intersection of AI and blockchain, and the expansion of blockchain applications beyond finance.

Blockchain in FinTech

Blockchain technology is expected to play a significant role in the future of FinTech, driving the development of new financial products and services.

Its ability to enhance security, reduce costs, and improve transparency makes it an attractive option for FinTech companies looking to disrupt traditional financial services.

AI and Blockchain

The combination of AI and blockchain represents a powerful convergence of technologies that could further revolutionize the financial industry.

AI can enhance blockchain processes by improving data analysis, automating complex tasks, and increasing the efficiency of financial operations.

This synergy is likely to drive innovation and create new opportunities for Blockchain Financial Transformation.

Predicted Trends for 2025 and Beyond

Looking ahead, Blockchain Financial Transformation is expected to expand into new areas of finance, including insurance and real estate.

The adoption of central bank digital currencies (CBDCs) is also likely to increase, with blockchain playing a central role in their implementation.

As technology continues to evolve, the applications and benefits of blockchain will only grow, making it an indispensable part of the future financial landscape.

Blockchain and Regulatory Environment

The regulatory environment for Blockchain Financial Transformation is complex and constantly evolving.

Financial institutions must navigate global regulatory landscapes, address compliance challenges, and anticipate future regulatory developments.

1. Global Regulatory Landscape

The global regulatory landscape for Blockchain Financial Transformation varies widely. Some countries, like Switzerland and Singapore, have embraced blockchain technology and created regulatory frameworks that support its use.

Others, such as China and India, have imposed strict regulations that limit the use of blockchain, particularly in relation to cryptocurrencies.

Financial institutions operating across borders must navigate these differing regulations, which can be challenging.

2. Compliance Challenges

Compliance is a significant challenge in Blockchain Financial Transformation.

Financial institutions must ensure that their blockchain applications comply with a complex web of regulations, including those related to data protection, anti-money laundering (AML), and know-your-customer (KYC) requirements.

Failure to comply with these regulations can result in severe penalties, making compliance a top priority.

3. Future of Regulation

As Blockchain Financial Transformation becomes more widespread, we can expect to see more comprehensive regulatory frameworks being developed.

These frameworks are likely to focus on ensuring the security and integrity of blockchain systems, protecting consumers, and preventing financial crime.

Financial institutions must stay informed about regulatory developments and be prepared to adapt to new requirements as they emerge.

Actionable Tips for Adopting Blockchain in Finance

For financial institutions considering Blockchain Financial Transformation, there are several actionable steps that can help ensure a successful implementation.

These include getting started with a clear strategy, following best practices, and avoiding common pitfalls.

Getting Started

Financial institutions looking to adopt Blockchain Financial Transformation should begin by developing a clear strategy.

This strategy should identify the areas where blockchain can add the most value, such as improving efficiency, reducing costs, or enhancing security.

It should also consider the specific challenges and opportunities that blockchain presents for the organization.

Best Practices

Adopting best practices is crucial for the successful implementation of Blockchain Financial Transformation.

These practices include investing in robust security measures, ensuring compliance with regulations, and collaborating with technology partners who have experience in blockchain implementation.

By following these best practices, financial institutions can minimize risks and maximize the benefits of blockchain technology.

Common Pitfalls to Avoid

There are several common pitfalls that financial institutions should avoid when adopting Blockchain Financial Transformation.

These include underestimating the complexity of integrating blockchain with existing systems, neglecting to plan for scalability, and failing to invest in the necessary technology and expertise.

Avoiding these pitfalls is essential for ensuring a smooth and successful transition to blockchain-based systems.

Impact on Consumers and Businesses

Blockchain Financial Transformation has far-reaching implications for both consumers and businesses.

By providing more transparent, secure, and efficient financial services, blockchain technology benefits a wide range of stakeholders.

1. Consumer Benefits

For consumers, Blockchain Financial Transformation offers several significant advantages.

These include increased transparency in financial transactions, reduced costs for financial services, and enhanced security for personal and financial data.

By reducing the need for intermediaries, blockchain also makes financial services more accessible to a broader population, particularly in regions where traditional banking infrastructure is lacking.

2. Business Advantages

For businesses, Blockchain Financial Transformation offers the potential to improve efficiency, reduce costs, and enhance security.

By automating processes and reducing the time required for transaction settlement, blockchain enables businesses to operate more efficiently and profitably.

It also provides greater transparency in supply chains, reducing the risk of fraud and improving relationships with suppliers and customers.

Case Studies

Several businesses have already begun to realize the benefits of Blockchain Financial Transformation.

For example, companies in the supply chain and payment processing sectors have used blockchain to streamline operations, reduce fraud, and improve transparency.

These case studies provide valuable insights into the potential of blockchain technology and demonstrate its real-world impact.

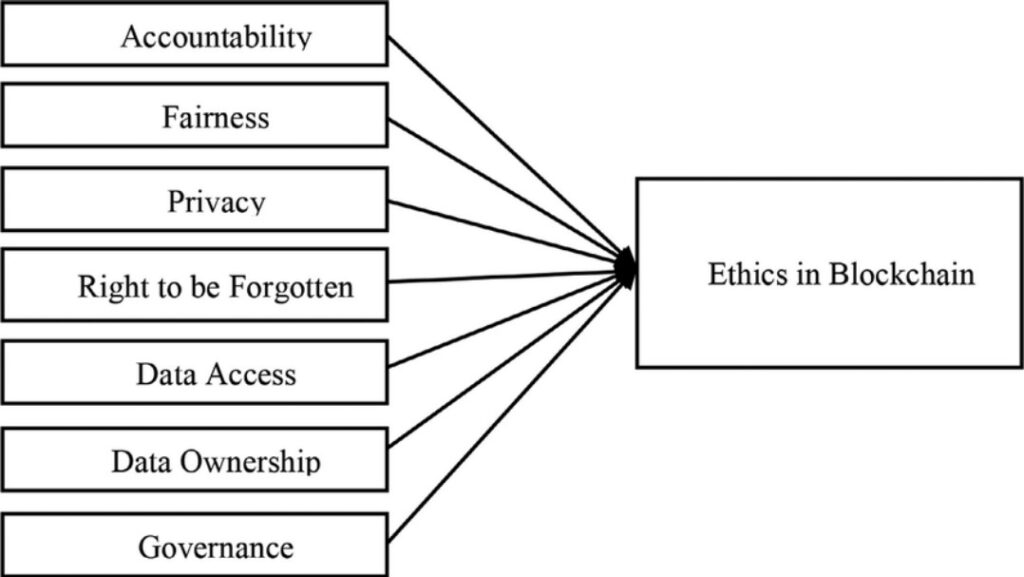

Ethical Considerations and Risks

While Blockchain Financial Transformation offers many benefits, it also raises important ethical considerations and risks.

Financial institutions must carefully consider these issues to ensure that their use of blockchain technology is responsible and ethical.

1. Privacy Concerns

One of the primary ethical concerns associated with Blockchain Financial Transformation is privacy.

While blockchain offers transparency, it can also expose sensitive financial information if not properly managed.

Financial institutions must ensure that they have robust data protection measures in place to protect the privacy of their customers.

2. Data Security

Data security is another significant concern in Blockchain Financial Transformation.

Financial institutions must ensure that their blockchain systems are secure from unauthorized access and cyberattacks.

This requires investing in advanced cryptographic techniques and regularly updating security protocols to address emerging threats.

3. Ethical Challenges

Blockchain technology also presents several ethical challenges.

These include issues related to data ownership, the potential for technology misuse, and the environmental impact of blockchain networks.

Financial institutions must carefully consider these challenges and take steps to mitigate them, ensuring that their use of blockchain is both ethical and sustainable.

Blockchain and Financial Inclusion

Blockchain Financial Transformation has the potential to significantly enhance financial inclusion, particularly in developing countries where access to traditional financial services is limited.

By providing more accessible, affordable, and secure financial services, blockchain technology can help to reduce financial inequality and support economic development.

1. Banking the Unbanked

One of the most significant ways that Blockchain Financial Transformation can enhance financial inclusion is by providing financial services to underserved populations.

In many developing countries, traditional banking infrastructure is lacking, making it difficult for people to access financial services.

Blockchain technology can provide an alternative, enabling people to access banking services through their smartphones or other digital devices.

2. Reducing Inequality

By lowering the barriers to financial services, Blockchain Financial Transformation can help to reduce financial inequality.

This is particularly important in regions where access to traditional financial services is limited or prohibitively expensive.

By providing more affordable and accessible financial services, blockchain technology can help to empower individuals and communities, supporting economic development and reducing inequality.

3. Microfinance and Blockchain

Blockchain technology can also enhance microfinance by providing secure, transparent platforms for small loans.

Microfinance is a critical tool for supporting entrepreneurship in low-income communities, and blockchain can help to make these services more accessible and efficient.

By providing a secure and transparent platform for microfinance transactions, blockchain can help to reduce the risk of fraud and ensure that funds are used effectively.

Monetization Opportunities (Affiliate Marketing)

For bloggers and content creators, Blockchain Financial Transformation offers several monetization opportunities through affiliate marketing.

By promoting blockchain platforms, services, and educational resources, you can generate income while providing valuable information to your audience.

Promoting Blockchain Platforms

One of the most straightforward ways to monetize content about Blockchain Financial Transformation is by promoting blockchain platforms like Ethereum, Hyperledger, and Ripple.

These platforms offer affiliate programs that allow you to earn a commission for referring customers.

Blockchain Services

In addition to platforms, there are also opportunities to promote blockchain-related services, such as consulting, development, and training.

These services are essential for businesses looking to adopt blockchain technology, and by recommending reputable providers, you can earn affiliate commissions.

Educational Resources

Finally, you can monetize your content by promoting educational resources about blockchain technology.

This might include online courses, books, or webinars that help people learn more about Blockchain Financial Transformation.

These resources are in high demand, particularly as more people look to understand and adopt blockchain technology.

FAQs and Common Misconceptions

1. What is Blockchain Financial Transformation?

Blockchain Financial Transformation refers to the integration of blockchain technology into financial systems, enhancing transparency, security, and efficiency.

2. How does blockchain improve financial transactions?

Blockchain improves financial transactions by providing a secure, decentralized platform that reduces the risk of fraud and lowers transaction costs.

3. What are the main challenges of adopting blockchain in finance?

The main challenges include regulatory hurdles, high initial costs, and the complexity of integrating blockchain with existing legacy systems.

4. What are some common misconceptions about blockchain?

A common misconception is that blockchain is only useful for cryptocurrencies. In reality, Blockchain Financial Transformation extends far beyond crypto, impacting various areas of finance.

Conclusion: The Future of Blockchain Financial Transformation

Blockchain Financial Transformation is set to continue its positive impact on the financial industry, overcoming challenges and unlocking new opportunities.

As technology evolves, so too will the applications and benefits of blockchain, making it an indispensable part of the future financial landscape.