As small businesses strive to manage their finances efficiently, selecting the right Accounting Software becomes crucial.

With technological advancements, the market is flooded with various options, making it challenging to choose the best one.

In 2025, the landscape of Accounting Software has evolved, offering features that cater specifically to the needs of small businesses.

This article will explore the top Accounting Software options for 2025, ensuring that your business remains financially sound and compliant.

Verdict

The right Accounting Software can transform how your small business handles finances.

In 2025, several top-tier software solutions offer robust features that streamline accounting processes, enhance accuracy, and save time.

Whether you are a sole proprietor or managing a team, choosing the right software can make a significant difference in your business’s financial health.

What is Accounting Software?

Accounting Software is a digital tool designed to manage and record your business’s financial transactions.

It helps in tracking income, expenses, invoicing, payroll, and other financial activities, providing an accurate and real-time view of your financial health.

This software is essential for ensuring compliance with tax regulations, generating financial reports, and making informed business decisions.

Why Should You Consider Accounting Software?

Small businesses should consider using Accounting Software for several compelling reasons:

- Efficiency: Automates repetitive tasks such as invoicing, billing, and payroll.

- Accuracy: Reduces human errors in financial calculations and record-keeping.

- Compliance: Ensures that your business adheres to tax laws and regulations.

- Financial Insights: Provides detailed reports that help in understanding the financial standing of your business.

- Scalability: Adapts to your business’s growth, offering more features as needed.

Best Features for Accounting Software in 2025

When selecting Accounting Software for your small business in 2025, consider these best features:

- User-Friendly Interface: Easy navigation and intuitive design.

- Integration Capabilities: Seamless integration with other business tools.

- Customizable Reports: Tailored financial reports to meet specific business needs.

- Cloud-Based Access: Accessibility from anywhere, ensuring real-time updates.

- Advanced Security: Robust security features to protect sensitive financial data.

Top 5 Recent Accounting Software for Small Businesses in 2025

The following are the top 5 Accounting Software for small businesses in 2025, each offering unique features and benefits:

1. QuickBooks Online

Best For: Comprehensive small business accounting.

Best Features: Extensive app integrations, user-friendly interface.

Product Descriptions: QuickBooks Online is a leading accounting software tailored for small businesses.

It offers a full suite of accounting tools, including invoicing, payroll, and expense tracking, making it a versatile option for businesses of all sizes.

Ryan’s Advice: Ideal for small businesses that require a robust, all-in-one accounting solution.

Best Features for QuickBooks Online:

- Automated Invoicing: Streamlines billing processes.

- Detailed Financial Reports: Provides insights into financial health.

- Multi-User Access: Allows multiple team members to collaborate.

- Tax Calculation: Simplifies tax preparation and filing.

- Inventory Tracking: Manages product inventory efficiently.

User Experiences and Case Studies: QuickBooks Online has been praised by small business owners for its ease of use and ability to integrate with other business tools, leading to significant time savings and better financial management.

Price Range: $25 – $150 per month, depending on the plan.

2. Xero

Best For: Small businesses needing strong integration with third-party apps.

Best Features: Excellent mobile app, strong payroll features.

Product Descriptions: Xero is an accounting software designed with small businesses in mind, offering seamless integration with various third-party applications.

It is particularly known for its real-time financial monitoring and powerful payroll capabilities.

Ryan’s Advice: Perfect for businesses that rely heavily on app integrations and need comprehensive payroll management.

Best Features for Xero:

- Multi-Currency Support: Facilitates international transactions.

- Smart Bank Reconciliation: Automatically matches bank transactions.

- Real-Time Cash Flow Tracking: Keeps your business finances up-to-date.

- Easy Payroll Processing: Manages employee payments with ease.

- Unlimited Users: Allows unrestricted team access.

User Experiences and Case Studies: Users appreciate Xero’s ability to integrate with other business tools, making it easier to manage various aspects of their operations from a single platform.

Price Range: $13 – $70 per month.

3. FreshBooks

Best For: Freelancers and service-based businesses.

Best Features: Time tracking, invoicing.

Product Descriptions: FreshBooks is an intuitive accounting software that excels in invoicing and time tracking, making it an excellent choice for freelancers and service-oriented businesses.

It simplifies client management and ensures that your billing is always accurate.

Ryan’s Advice: Ideal for freelancers who need an easy-to-use accounting tool that helps them manage their client invoicing and expenses.

Best Features for FreshBooks:

- Project Management Tools: Streamlines project and client management.

- Expense Tracking: Keeps tabs on business expenses effortlessly.

- Time Tracking: Logs billable hours accurately.

- Customizable Invoicing: Tailors invoices to client needs.

- Automatic Payment Reminders: Ensures timely payments from clients.

User Experiences and Case Studies: FreshBooks is favored by freelancers for its simplicity and efficiency in managing client relationships and billing processes.

Price Range: $15 – $50 per month.

4. Zoho Books

Best For: Small businesses with a focus on scalability.

Best Features: Workflow automation, integrated inventory management.

Product Descriptions: Zoho Books is a comprehensive accounting software that integrates seamlessly with the Zoho suite of business applications.

It offers extensive features like workflow automation and inventory management, making it a scalable solution for growing businesses.

Ryan’s Advice: Best for small businesses already using Zoho’s suite of tools, looking for seamless integration and scalability.

Best Features for Zoho Books:

- Automated Workflows: Streamlines repetitive accounting tasks.

- Multi-Currency Handling: Simplifies international business transactions.

- Client Portal: Provides clients with access to their accounts.

- Customizable Reports: Tailors financial reports to specific needs.

- Comprehensive Dashboard: Offers a complete view of business finances.

User Experiences and Case Studies: Users highlight Zoho Books’ ease of integration with other Zoho tools, which helps them manage their entire business operations efficiently.

Price Range: $15 – $60 per month.

5. Wave

Best For: Startups and micro-businesses looking for a free solution.

Best Features: Free invoicing, accounting, and receipt scanning.

Product Descriptions: Wave provides a completely free accounting solution, perfect for startups and micro-businesses.

It covers basic accounting needs, including invoicing, expense tracking, and receipt scanning, without any hidden costs.

Ryan’s Advice: Ideal for small businesses and startups that need essential accounting features without the financial burden of a paid service.

Best Features for Wave

- Free Accounting Tools: Provides all essential accounting features at no cost.

- Receipt Scanning via Mobile App: Captures and records expenses easily.

- Invoicing and Payment Processing: Facilitates timely billing and payments.

- Double-Entry Accounting: Ensures accuracy in financial records.

- Expense Tracking: Keeps all business expenses organized.

User Experiences and Case Studies: Wave is often lauded by startups for offering a fully functional, free accounting platform that meets their basic needs without any upfront investment.

Price Range: Free (with optional paid services for payroll and payments).

How to Choose the Best Accounting Software for Your Small Business

Choosing the right accounting software for your small business is crucial for managing your finances efficiently and ensuring compliance with tax regulations.

With numerous options available, it’s essential to select a solution that aligns with your business’s specific needs.

Here’s a detailed guide to help you make an informed decision:

1. Assess Your Business Needs

- Understand Your Requirements: The first step in choosing the best accounting software is to identify your business’s financial management needs. Consider factors such as invoicing, payroll, expense tracking, and reporting. Knowing what you need will help narrow down your options.

- Scalability: Ensure the software can grow with your business. As your business expands, your accounting software should be able to handle increased transactions, additional users, and more complex financial reporting.

2. Budget Considerations

- Cost vs. Value: While cost is a significant factor, it’s essential to focus on the value the accounting software provides. A higher upfront cost may be justified if the software offers features that save time and reduce errors.

- Subscription Models: Many accounting software options offer tiered pricing models. Choose a plan that fits your current needs, with the flexibility to upgrade as your business grows.

3. User-Friendliness

- Ease of Use: The best accounting software should have an intuitive interface that makes it easy for you and your team to use. Consider software that offers a trial period so you can assess its user experience before committing.

- Support and Training: Look for software that provides adequate support and training resources. This can include tutorials, webinars, and customer support to ensure you can use the software effectively.

4. Integration Capabilities

- Third-Party Integrations: Your accounting software should seamlessly integrate with other business tools you use, such as CRM systems, payroll services, and payment gateways. This will streamline your operations and reduce the need for manual data entry.

- Automation Features: Consider software that offers automation for repetitive tasks, such as invoicing and expense tracking. This not only saves time but also minimizes the risk of errors.

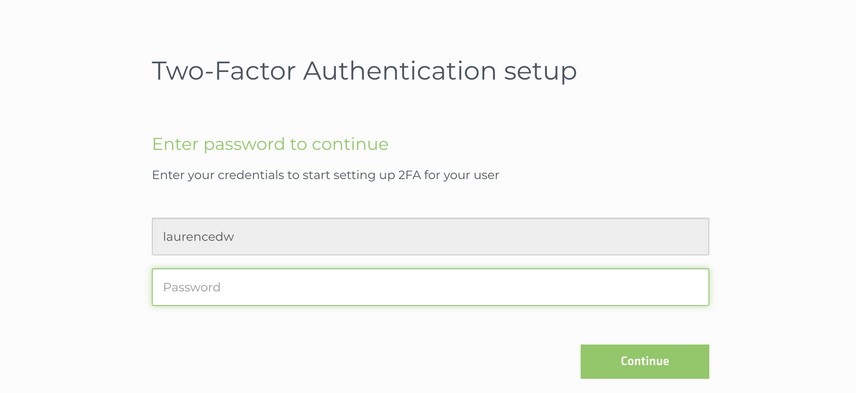

5. Security and Compliance

- Data Security: Ensure the accounting software you choose offers robust security features, such as encryption and two-factor authentication, to protect your financial data from unauthorized access.

- Compliance: The software should help you comply with local tax laws and regulations. Look for features that automate tax calculations and generate necessary reports for tax filings.

Top Benefits of Using Accounting Software for Small Businesses

Accounting software is not just a tool for tracking income and expenses; it’s a comprehensive solution that can transform how you manage your business’s finances.

Here are the top benefits of using accounting software for small businesses :

1. Improved Accuracy

- Automated Calculations: Accounting software automates calculations, reducing the chances of human error. This ensures your financial records are accurate and reliable.

- Real-Time Data: With accounting software, you get real-time access to your financial data, allowing you to make informed decisions quickly.

2. Time Efficiency

- Streamlined Processes: Tasks that used to take hours, such as invoicing, payroll, and bank reconciliation, can now be completed in minutes with accounting software.

- Automation: The software automates repetitive tasks, freeing up your time to focus on growing your business.

3. Financial Insights

- Customizable Reports: Accounting software generates detailed financial reports that give you insights into your business’s performance. You can customize these reports to focus on specific aspects of your business, such as cash flow, profitability, or expenses.

- Forecasting Tools: Some accounting software includes forecasting tools that help you predict future financial trends and make proactive business decisions.

4. Better Tax Compliance

- Automated Tax Calculations: Accounting software helps you stay compliant with tax regulations by automating tax calculations and generating necessary tax reports.

- Record Keeping: The software keeps all your financial records organized and accessible, making it easier to file taxes and respond to any audits.

5. Enhanced Collaboration

- Multi-User Access: Many accounting software solutions allow multiple users to access the system simultaneously, making it easier for your team to collaborate on financial tasks.

- Cloud-Based Access: With cloud-based accounting software, you can access your financial data from anywhere, ensuring that you and your team can work remotely if needed.

Is Accounting Software Worth the Investment for Small Businesses?

Investing in accounting software can be a significant decision for small businesses, especially when budgets are tight.

However, the benefits often outweigh the costs.

Here’s why accounting software is worth the investment:

1. Cost vs. Value

- Initial Costs: While some accounting software may have high upfront costs, these are often offset by the long-term savings. The automation of financial processes can save you considerable time, which translates into cost savings.

- Reduced Errors: The cost of human error in financial management can be high. Accounting software reduces these errors, potentially saving you from costly mistakes and penalties.

2. Long-Term Savings

- Efficiency Gains: Accounting software streamlines your financial processes, reducing the need for extensive manual work and the associated labor costs.

- Scalability: As your business grows, accounting software can scale with you, meaning you won’t have to invest in new solutions as your needs change.

3. Improved Cash Flow Management

- Timely Invoicing: Accounting software helps you manage cash flow by automating invoicing and tracking payments, ensuring that you get paid on time.

- Expense Tracking: By keeping track of all your expenses, accounting software helps you identify areas where you can cut costs and improve profitability.

4. Compliance and Security

- Regulatory Compliance: Accounting software ensures that your business complies with local tax regulations, helping you avoid penalties and fines.

- Data Security: The software offers advanced security features that protect your financial data from breaches, giving you peace of mind.

Common Mistakes Small Businesses Make When Using Accounting Software and How to Avoid Them

While accounting software can greatly benefit your business, it’s essential to use it correctly.

Here are some common mistakes small businesses make when using accounting software and how to avoid them:

1. Not Regularly Updating Financial Data

- The Mistake: Some businesses fail to update their financial data regularly, leading to inaccurate records and reports.

- How to Avoid: Set a schedule for updating your financial data daily or weekly. Most accounting software allows you to automate data entry, ensuring your records are always up-to-date.

2. Overlooking Software Training

- The Mistake: Not taking the time to learn how to use the accounting software properly can lead to errors and inefficiencies.

- How to Avoid: Invest time in training. Many software providers offer tutorials, webinars, and customer support to help you get the most out of their product.

3. Ignoring Customization Options

- The Mistake: Sticking with the default settings instead of customizing the software to suit your business’s needs can limit the software’s effectiveness.

- How to Avoid: Take advantage of customization options. Most accounting software allows you to tailor reports, dashboards, and features to better meet your business’s specific needs.

4. Not Backing Up Data

- The Mistake: Failing to back up your financial data can result in data loss if there’s a system failure.

- How to Avoid: Use accounting software that offers automatic backups. Regularly check that your data is being backed up and can be restored if needed.

5. Misclassifying Expenses

- The Mistake: Misclassifying expenses can lead to inaccurate financial statements and tax reports.

- How to Avoid: Use the software’s categorization features to correctly classify expenses. Regularly review and adjust categories as needed.

Future Trends in Accounting Software for Small Businesses: What to Expect in 2025 and Beyond

The landscape of accounting software is continuously evolving, with new technologies and features emerging each year.

Here are the key trends in accounting software for small businesses in 2025 and beyond:

1. Increased Use of AI and Automation

- Trend: Artificial intelligence (AI) and automation are becoming more prevalent in accounting software, helping to streamline processes like data entry, expense tracking, and financial forecasting.

- Impact: These technologies reduce the manual effort required in accounting, allowing businesses to focus more on strategic activities.

2. Enhanced Data Analytics

- Trend: Accounting software is increasingly incorporating advanced data analytics tools that provide deeper insights into business finances.

- Impact: Businesses can leverage these insights to make more informed financial decisions and improve their overall financial health.

3. Integration with Blockchain Technology

- Trend: Blockchain technology is starting to be integrated into accounting software, particularly in areas like transaction verification and smart contracts.

- Impact: This integration enhances the security and transparency of financial transactions, making them more reliable and tamper-proof.

4. Cloud-Based Solutions

- Trend: Cloud-based accounting software continues to dominate the market, offering greater accessibility, scalability, and security.

- Impact: Businesses benefit from the flexibility of accessing their financial data from anywhere, with the assurance that their data is secure and always backed up.

5. Focus on User Experience

- Trend: As more businesses adopt accounting software, providers are focusing on improving the user experience with more intuitive interfaces and better customer support.

- Impact: A better user experience reduces the learning curve and increases the efficiency of financial management.

Success Stories: How Small Businesses Are Thriving with Accounting Software in 2025

Real-life examples of small businesses using accounting software can inspire others to take the plunge.

Here are some success stories:

1. Streamlining Operations with QuickBooks Online

- The Business: A small retail store in New York.

- The Challenge: The business struggled with manual bookkeeping, leading to errors and inefficiencies.

- The Solution: They implemented QuickBooks Online, which automated their invoicing, expense tracking, and payroll processes.

- The Result: The store saw a 40% reduction in time spent on accounting tasks, allowing them to focus more on customer service and inventory management.

2. Scaling with Xero

- The Business: A growing e-commerce business.

- The Challenge: As the business expanded, managing finances across multiple sales channels became difficult.

- The Solution: They adopted Xero, which offered seamless integration with their sales platforms and provided real-time financial insights.

- The Result: The business was able to scale effectively, with a 50% increase in revenue and better financial control.

3. Enhancing Client Management with FreshBooks

- The Business: A freelance graphic design firm.

- The Challenge: Managing multiple client projects and invoicing was becoming overwhelming.

- The Solution: FreshBooks allowed them to track time, manage projects, and send invoices efficiently.

- The Result: The firm improved its cash flow by 30% and reduced late payments significantly.

How to Integrate Accounting Software with Other Business Tools for Maximum Efficiency

Integrating accounting software with other business tools can significantly enhance your business’s efficiency.

Here’s how to do it:

1. Identify Essential Integrations

- Key Tools: Consider the business tools you use most frequently, such as CRM systems, payroll services, and e-commerce platforms. Ensure that your accounting software can integrate with these tools seamlessly.

2. Automate Data Syncing

- Automation Benefits: Integrations that allow for automatic data syncing can save time and reduce errors. For example, integrating your accounting software with your e-commerce platform can automatically update your sales and inventory data.

3. Use APIs for Custom Integrations

- Custom Solutions: If your business uses specialized tools, consider using APIs (Application Programming Interfaces) to create custom integrations with your accounting software.

4. Streamline Reporting

- Consolidated Reports: Integrations should allow you to consolidate data from various tools into a single report, giving you a comprehensive view of your business’s financial health.

How Secure Is Your Accounting Software? A Guide to Protecting Your Financial Data in 2025

Security is a top priority for any business using accounting software.

Here’s how to ensure your financial data is protected:

1. Choose Software with Strong Encryption

- Encryption Importance: Ensure that your accounting software uses strong encryption to protect your data from unauthorized access. This includes data both at rest and in transit.

2. Enable Two-Factor Authentication

- Extra Security Layer: Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device.

3. Regularly Update Your Software

- Importance of Updates: Software updates often include security patches that protect against the latest threats. Ensure your accounting software is always up-to-date.

4. Backup Your Data Regularly

- Data Recovery: Regular backups ensure that you can recover your data in case of a system failure or breach. Many accounting software solutions offer automatic backup options.

5. Monitor Access Controls

- Access Management: Ensure that only authorized personnel have access to your accounting software. Use role-based access controls to limit what different users can do within the system.

A Step-by-Step Guide to Setting Up Accounting Software for Your Small Business in 2025

Setting up accounting software for your small business doesn’t have to be daunting.

Follow this step-by-step guide to get started:

1. Choose the Right Software

- Assess Your Needs: Determine what features you need, such as invoicing, payroll, and reporting. Choose accounting software that meets these needs and fits your budget.

2. Gather Your Financial Information

- Required Data: Collect all necessary financial documents, such as bank statements, expense receipts, and previous financial reports, before setting up your software.

3. Install and Set Up the Software

- Installation Process: Follow the software provider’s instructions to install the accounting software on your computer or set it up in the cloud.

4. Customize the Settings

- Tailor to Your Business: Customize the software’s settings to suit your business’s needs. This includes setting up your chart of accounts, tax settings, and invoicing templates.

5. Import Financial Data

- Data Migration: Import your financial data into the accounting software. Most software offers tools to help you migrate data from spreadsheets or other accounting systems.

6. Set Up Bank Feeds

- Automate Transactions: Connect your business bank accounts to the accounting software to automatically import transactions and reconcile accounts.

7. Create User Accounts

- User Management: Set up accounts for your team members, assigning appropriate permissions based on their roles.

8. Generate Initial Reports

- Financial Overview: Run initial reports to ensure everything is set up correctly and to get a snapshot of your business’s financial health.

Frequently Asked Questions (FAQ) About Small Business Accounting in 2025

Q1: What is this type of software?

A1: It is a digital tool designed to help businesses manage their financial transactions, including invoicing, payroll, expense tracking, and financial reporting. It automates many tasks, reducing the risk of errors and saving time for business owners.

Q2: Why is this type of software important for small businesses?

A2: It is crucial for small businesses because it streamlines financial management, ensuring accuracy and compliance with tax regulations. It also provides real-time insights into your business’s financial health, helping you make informed decisions.

Q3: How do I choose the right one for my small business?

A3: To choose the right one, assess your business needs, consider your budget, and look for features that match your requirements, such as invoicing, payroll, and reporting. User-friendliness, integration capabilities, and security features are also essential factors to consider.

Q4: Can it help with tax compliance?

A4: Yes, most options include features that help with tax compliance by automating tax calculations, generating tax reports, and ensuring that your financial records are organized and accurate.

Q5: Is it worth investing in this kind of tool if my business is just starting out?

A5: Investing in such a tool is worthwhile even for startups because it saves time, reduces errors, and helps you manage your finances more efficiently. Many options offer affordable pricing plans or even free versions for small businesses.

Q6: What are the key benefits of using this software?

A6: The key benefits include improved accuracy, time efficiency, better financial insights, enhanced tax compliance, and the ability to collaborate with your team more effectively.