In today’s digital landscape, choosing the right Online Course Payment Platforms is crucial for educators, content creators, and institutions.

These platforms ensure that transactions are seamless, secure, and user-friendly, making it easier for you to monetize your knowledge and expertise.

In this comprehensive review, we will explore the top five payment platforms in 2025, offering you the best choices to manage payments for your online courses efficiently.

Verdict

Online Course Payment Platforms are indispensable for anyone looking to sell online courses effectively.

From comprehensive solutions like Teachable Payments to versatile options like Stripe, each platform reviewed offers unique benefits tailored to different needs.

When selecting a platform, consider the level of integration with your course platform, the transaction fees, and the scalability of the solution.

By choosing the right platform, you can enhance your course delivery, ensure secure transactions, and ultimately boost your revenue.

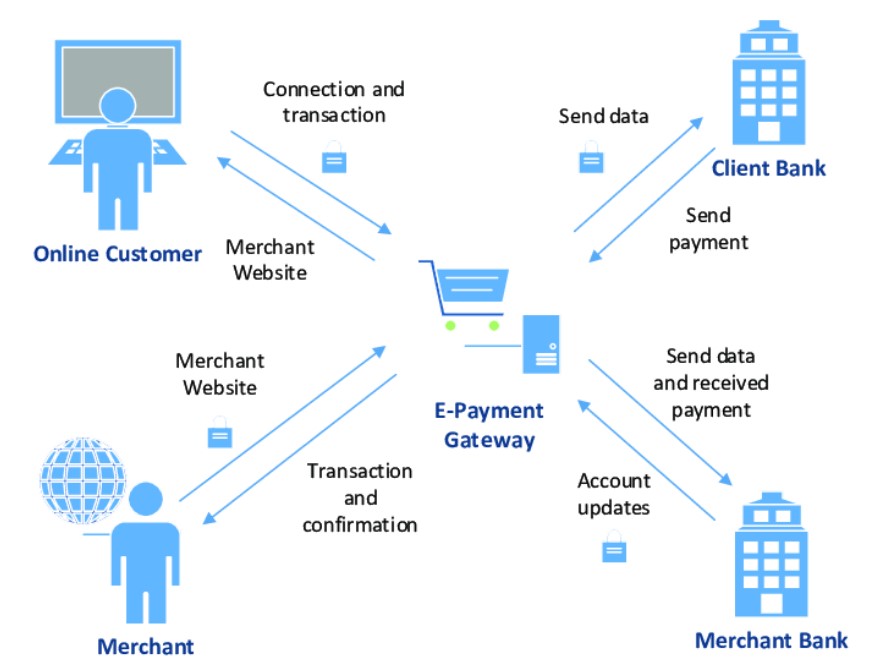

What Are Online Course Payment Platforms?

Online Course Payment Platforms are specialized tools that enable educators and course creators to accept payments for their online courses.

These platforms typically offer features like secure transactions, integration with learning management systems (LMS), support for multiple currencies, and customizable payment options.

They simplify the payment process for both course providers and students, ensuring smooth and reliable transactions.

Key Features

When selecting Online Course Payment Platforms, it’s essential to consider several key features that will significantly impact the platform’s ability to support your online business:

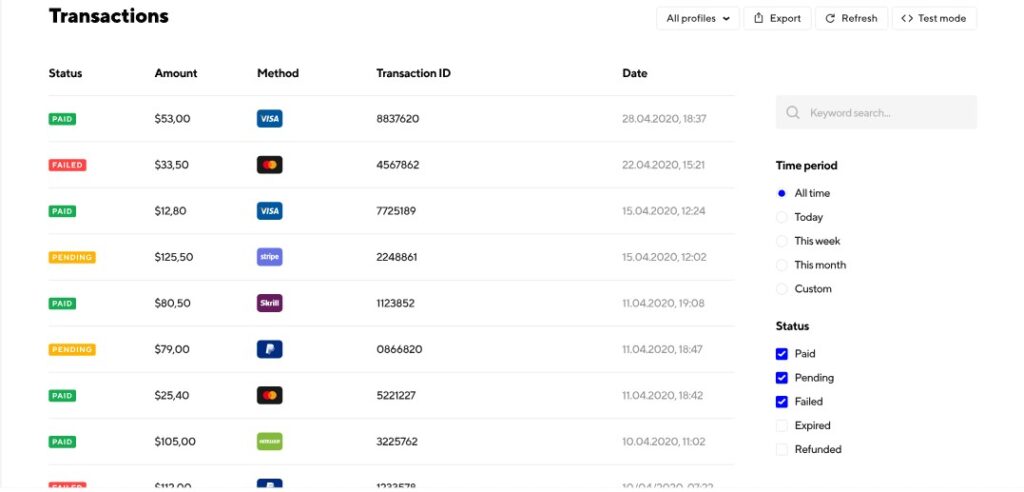

- Secure Transactions: Ensure that the platform uses advanced encryption and security protocols to protect both your and your students’ payment information.

- Multiple Payment Options: A good platform should support various payment methods, including credit cards, PayPal, and direct bank transfers, catering to a global audience.

- Seamless LMS Integration: The platform should integrate smoothly with popular LMS platforms, enabling automated payment processing and access management.

- Customizable Pricing Models: Look for platforms that allow you to create different pricing structures, such as one-time payments, subscriptions, or payment plans.

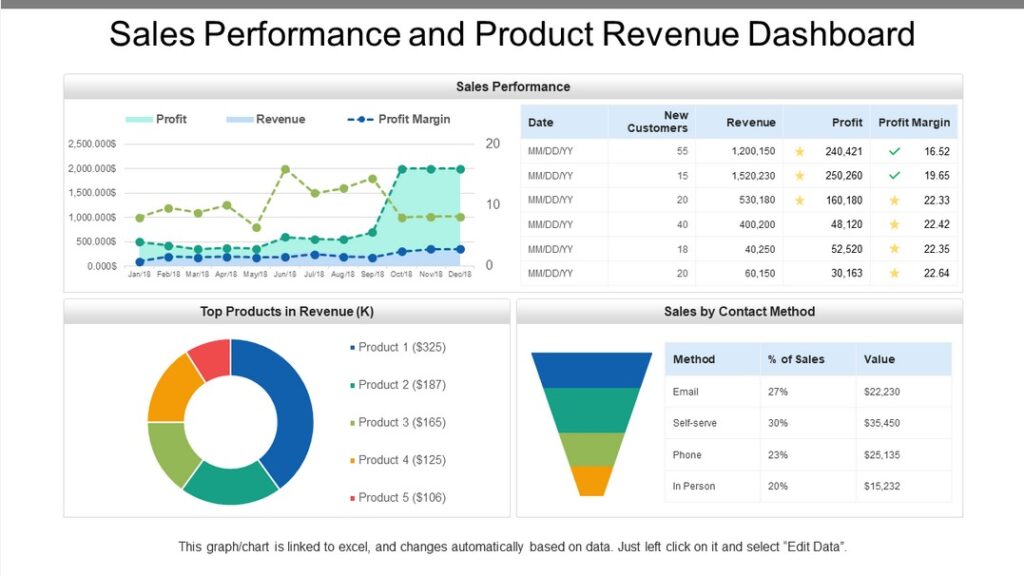

- Detailed Reporting: Comprehensive reporting tools help track revenue, monitor transaction history, and analyze sales data to optimize your pricing strategy.

What is the Best Online Course Payment Platform?

When determining the best Online Course Payment Platforms for your needs, it’s essential to evaluate the specific features, pricing, and user experience offered by each platform.

In this review, we selected platforms based on their comprehensive feature sets, ease of use, customer support, and scalability. These platforms have proven to consistently deliver value to users across various industries.

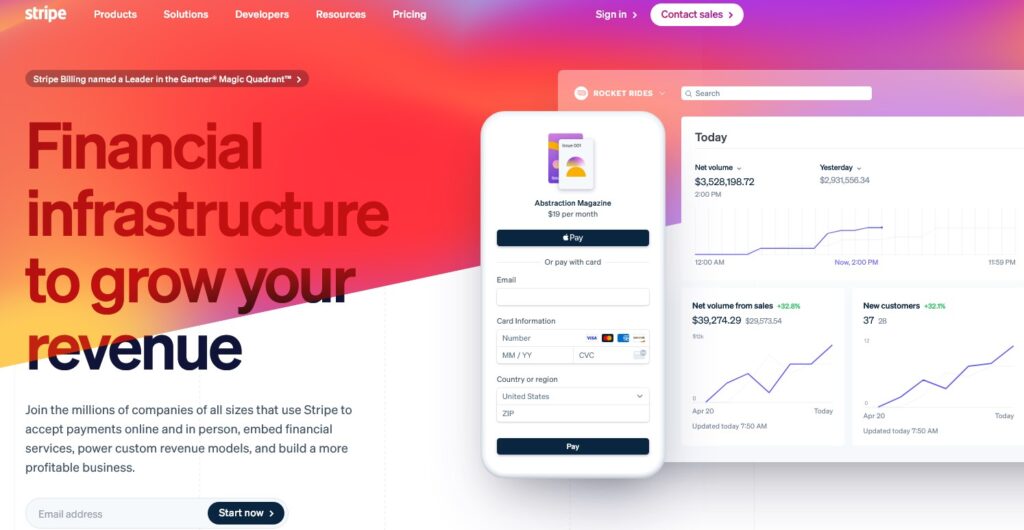

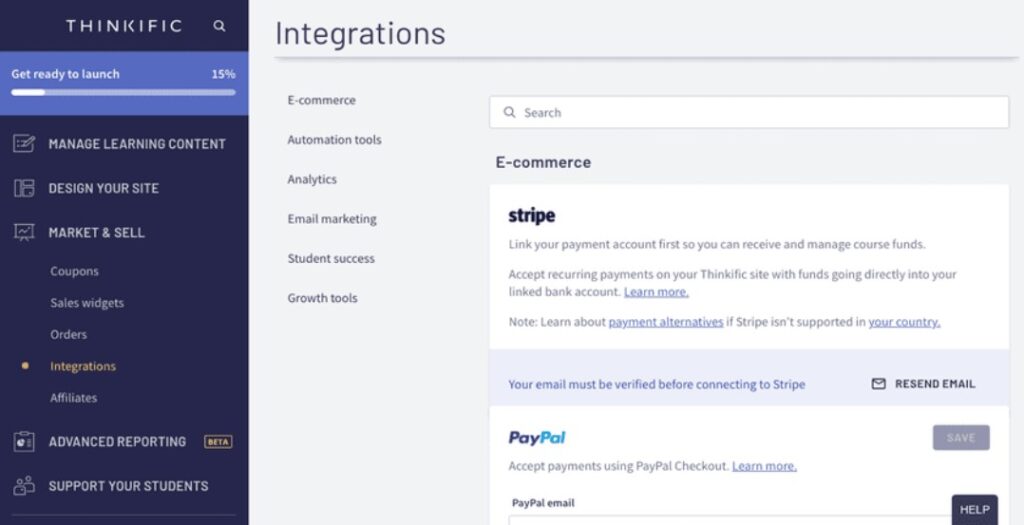

1. Stripe

Best For: Flexible and scalable payment processing for various online platforms.

Best Features: Customizable payment solutions with extensive API integration options.

Product Description: Stripe is a highly versatile payment processing platform that caters to a wide range of online businesses, including online course providers.

It offers robust API integration, allowing you to customize your payment process to fit your specific needs.

With support for multiple currencies, subscription models, and advanced security features, Stripe is an excellent choice for businesses looking for a flexible and reliable payment solution.

Ryan’s Advice: Perfect for those who need a highly customizable payment solution that can scale with their business.

Best Features for Online Course Payment Platforms:

- Extensive API Integration: Allows for complete customization of the payment process.

- Subscription Management: Easily set up recurring billing for subscription-based courses.

- Multi-Currency Support: Accept payments from around the world in various currencies.

- Advanced Security: Uses tokenization and encryption to secure payment data.

- Detailed Reporting: Access comprehensive transaction reports and analytics.

Product Pros:

- Highly customizable

- Strong security features

- Supports multiple currencies

- Scalable for businesses of all sizes

- Excellent developer tools and API documentation

Cons:

- Requires technical knowledge for setup

- Customer support can be limited for smaller accounts

User Experiences and Case Studies:

- Tech Startup: A coding bootcamp used Stripe’s API to integrate payment processing with their custom LMS, resulting in a 30% increase in student enrollment due to a smoother payment experience.

- E-Learning Platform: An online university used Stripe’s subscription management to offer monthly payment plans, increasing student retention by 20%.

- Freelance Educator: A fitness trainer integrated Stripe with her website, allowing for global payments and expanding her reach internationally.

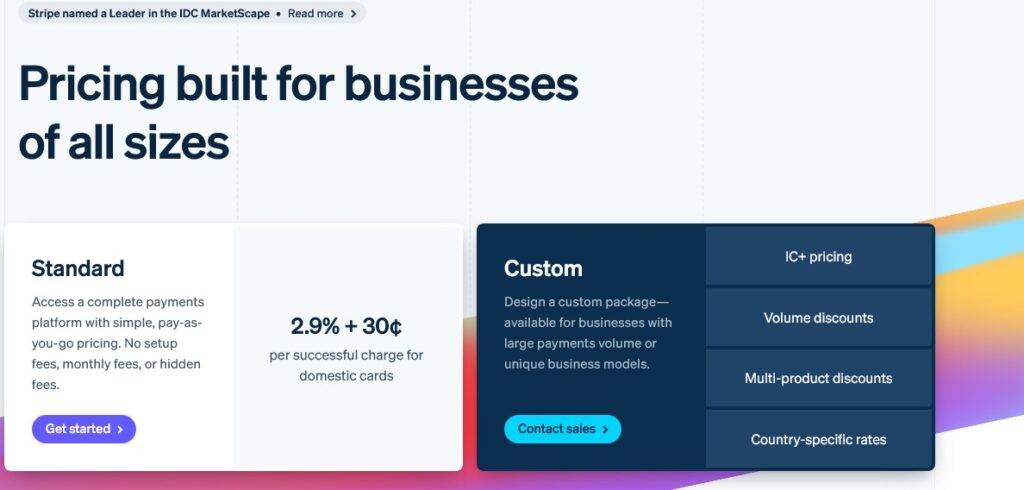

Pricing and Subscription:

- Pay-as-You-Go: 2.9% + 30¢ per successful card charge, with additional fees for international cards and currency conversion.

- Custom Pricing: Available for businesses with high volume or unique needs.

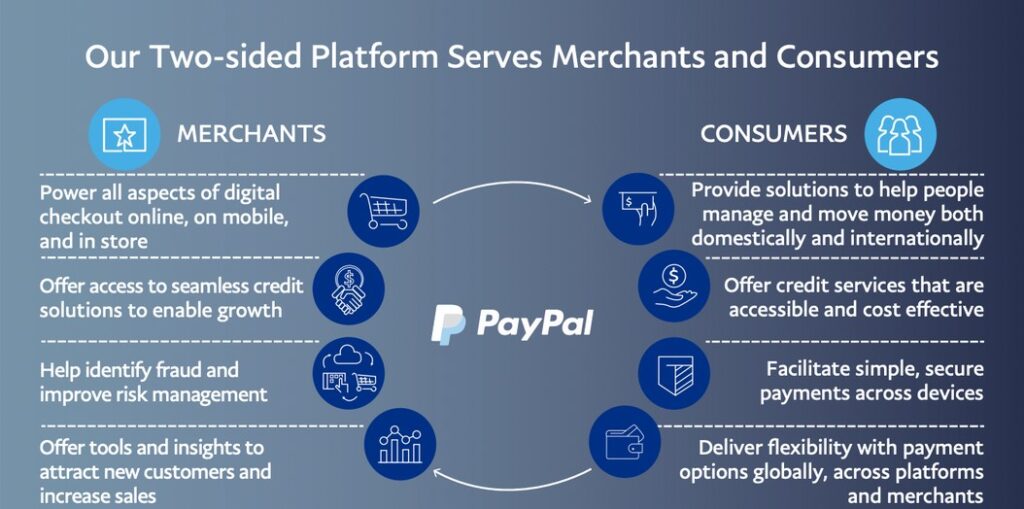

2. PayPal

Best For: Widely recognized payment solution with extensive global reach.

Best Features: Trusted brand with a straightforward checkout process and buyer protection.

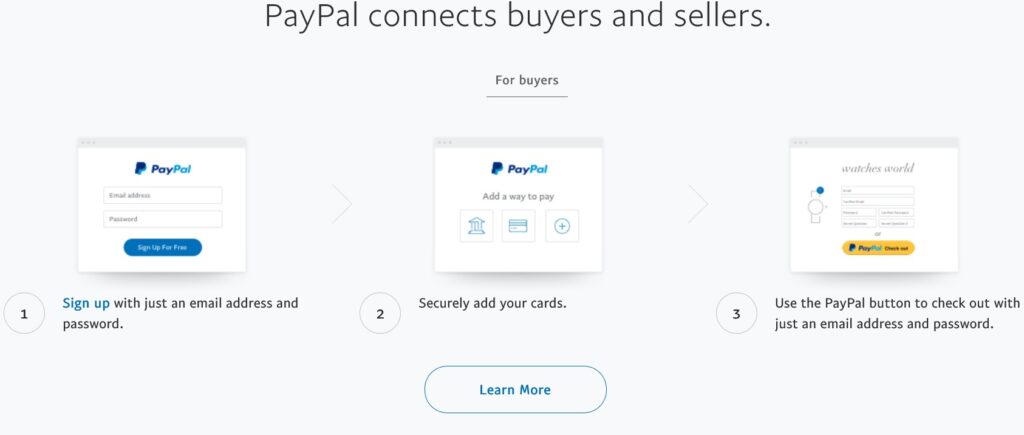

Product Description: PayPal is one of the most well-known payment platforms globally, offering a simple and secure way to accept payments for online courses.

Its ease of use and widespread adoption make it a go-to option for many online course creators.

PayPal supports various payment methods, including credit cards and PayPal accounts, and provides robust security features to protect both sellers and buyers.

Ryan’s Advice: Best for those who want a trusted and widely accepted payment method with minimal setup required.

Best Features for Online Course Payment Platforms:

- Global Reach: Accept payments from over 200 countries and 25 currencies.

- Simple Integration: Easily add PayPal as a payment option to most websites and platforms.

- Buyer Protection: Offers protection for both buyers and sellers, enhancing trust.

- Flexible Payment Options: Supports one-time payments, subscriptions, and invoicing.

- Mobile-Friendly Checkout: Optimized for mobile users, ensuring a smooth experience on all devices.

Product Pros:

- Easy to set up and use

- Trusted by consumers worldwide

- Supports multiple currencies

- Secure transactions with buyer protection

- Mobile-friendly interface

Cons:

- Higher transaction fees compared to some competitors

- Limited customization options

User Experiences and Case Studies:

- E-course Provider: An online marketing instructor increased sales by 20% by offering PayPal as a payment option, capitalizing on its global recognition and trust.

- Freelancer: A freelance writer used PayPal to manage payments for her writing courses, benefiting from the platform’s invoicing and buyer protection features.

- Small Business: A cooking school integrated PayPal into their website, simplifying the payment process for international students and increasing course enrollment.

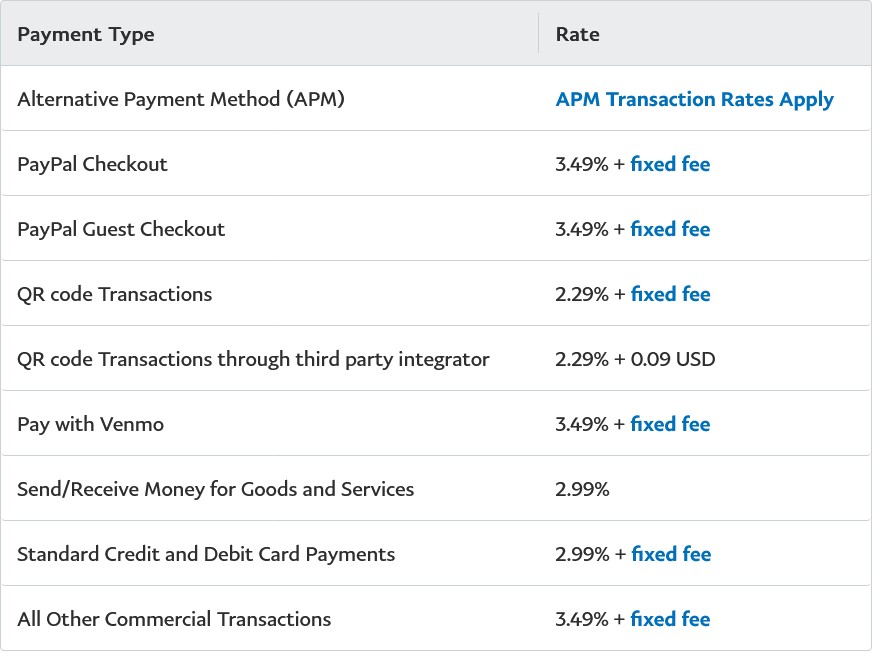

Pricing and Subscription:

- Standard Fees: 2.9% + 30¢ per transaction within the U.S., higher for international transactions.

- Micropayments: 5% + 5¢ per transaction for payments under $10.

- Custom Pricing: Available for high-volume merchants.

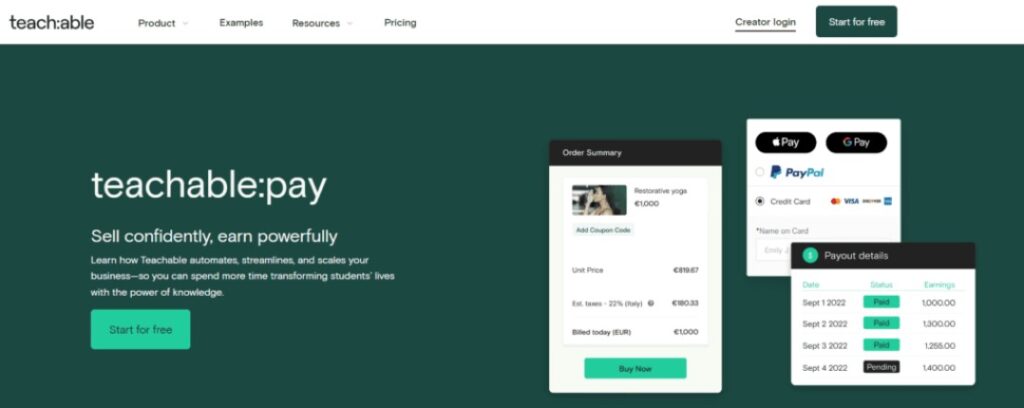

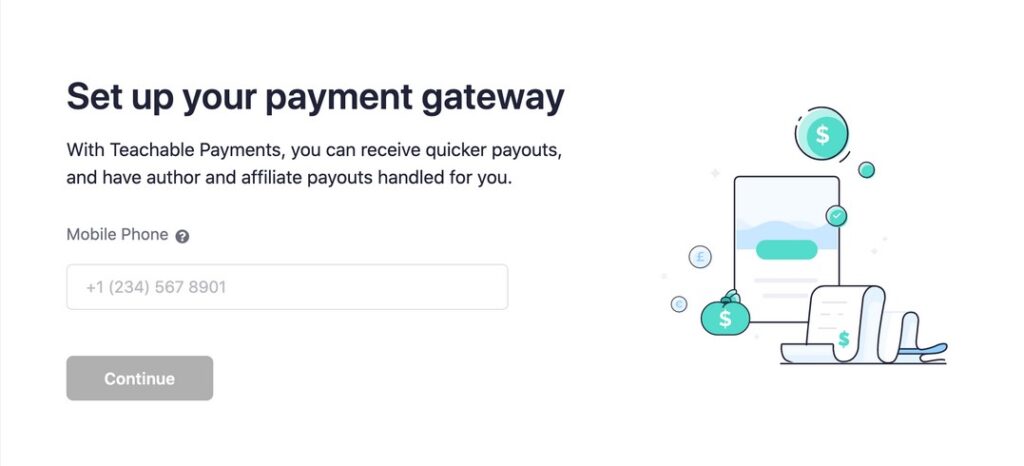

3. Teachable Payments

Best For: Comprehensive payment management integrated directly with course platforms.

Best Features: All-in-one payment solution for Teachable users, including automated payouts and tax handling.

Product Description: Teachable Payments is the built-in payment processing solution for the Teachable platform.

It offers seamless integration with your Teachable courses, allowing for automated payouts, tax form generation, and robust payment tracking.

With its user-friendly interface, you can manage all payment aspects directly within your Teachable dashboard.

Ryan’s Advice: Ideal for Teachable users looking for a hassle-free, integrated payment solution.

Best Features for Online Course Payment Platforms:

- Automated Payouts: Streamlines the process by automatically disbursing earnings on a set schedule.

- Tax Handling: Generates necessary tax forms and handles VAT for EU customers.

- Multi-Currency Support: Accept payments in various currencies, catering to a global audience.

- Flexible Pricing Models: Supports subscriptions, one-time payments, and payment plans.

- Integrated Reporting: Provides detailed analytics on revenue, transactions, and student payments.

Product Pros:

- Direct integration with Teachable

- Automated tax handling

- Multi-currency support

- Flexible pricing options

- User-friendly dashboard

Cons:

- Limited to Teachable platform

- Higher transaction fees compared to standalone processors

User Experiences and Case Studies:

- Educator: A language instructor used Teachable Payments to manage her online courses, resulting in a 15% increase in course enrollment due to the platform’s streamlined checkout process.

- Content Creator: A photography course creator found the automated payouts and tax handling invaluable, reducing administrative overhead by 40%.

- Small Business: An entrepreneurship coach leveraged the multi-currency support to expand her reach to international students, boosting revenue by 25%.

Pricing and Subscription:

- Free Plan: Available with Teachable Free, but with higher transaction fees.

- Basic Plan: $39/month, 5% transaction fees, includes integrated payment processing.

- Pro Plan: $119/month, 2% transaction fees, advanced features like subscription pricing.

- Pro + Plan: $199/month, no transaction fees, priority support, and advanced reporting.

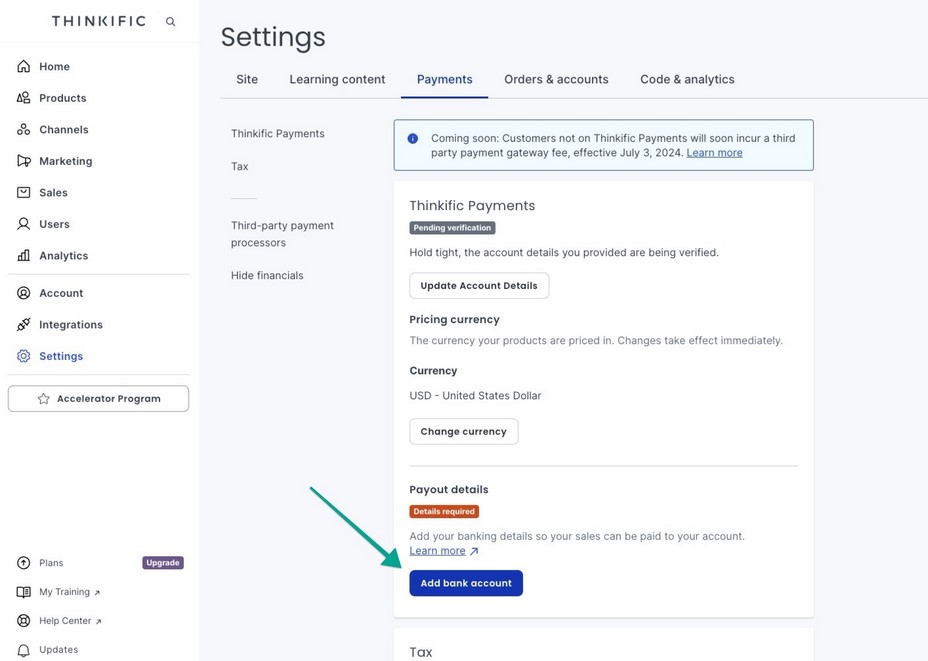

4. Thinkific Payments

Best For: Course creators using the Thinkific platform who need an integrated payment solution.

Best Features: Built-in payment processing with automatic payouts and comprehensive reporting.

Product Description: Thinkific Payments is the native payment solution for the Thinkific online course platform.

It offers a seamless payment experience for both course creators and students, with features like automated payouts, detailed reporting, and support for multiple currencies.

Thinkific Payments is designed to work perfectly with your Thinkific site, making it easy to manage all aspects of your course business from one place.

Ryan’s Advice: Ideal for Thinkific users who want an integrated payment solution without the need for third-party services.

Best Features for Online Course Payment Platforms:

- Automated Payouts: Automatically disburses earnings on a regular schedule.

- Multi-Currency Support: Accept payments in various currencies to cater to a global audience.

- Seamless Integration: Works flawlessly with Thinkific’s course management tools.

- Custom Pricing Options: Supports one-time payments, subscriptions, and payment plans.

- Comprehensive Reporting: Offers detailed insights into sales, transactions, and customer payments.

Product Pros:

- Direct integration with Thinkific

- Automated payouts

- Multi-currency support

- User-friendly interface

- Comprehensive reporting tools

Cons:

- Limited to the Thinkific platform

- Higher transaction fees compared to standalone processors

User Experiences and Case Studies:

- Course Creator: An online yoga instructor used Thinkific Payments to manage her course sales, benefiting from the platform’s automated payouts and ease of use, leading to a 20% increase in revenue.

- Small Business: A digital marketing school used Thinkific Payments to streamline their payment process, reducing administrative tasks by 35%.

- Freelance Educator: A business coach found Thinkific Payments’ multi-currency support essential for reaching international clients, resulting in a 25% increase in enrollments.

Pricing and Subscription:

- Free Plan: Available with Thinkific Free, but with higher transaction fees.

- Basic Plan: $49/month, includes payment processing with 5% transaction fees.

- Pro Plan: $99/month, 2% transaction fees, advanced features like subscription pricing.

- Premier Plan: $499/month, no transaction fees, priority support, and advanced reporting.

5. Paddle

Best For: SaaS and software companies offering online courses with a focus on global sales.

Best Features: Comprehensive payment solution with built-in tax compliance and subscription management.

Product Description: Paddle is a payment platform designed for SaaS businesses, offering a complete solution for selling software and digital products, including online courses.

It handles everything from payment processing to tax compliance, allowing you to focus on creating and selling your courses.

Paddle’s all-in-one approach makes it particularly appealing for businesses selling internationally, as it automatically handles VAT, sales tax, and other compliance issues.

Ryan’s Advice: Highly recommended for SaaS companies and software businesses looking for a comprehensive payment solution that simplifies tax compliance.

Best Features for Online Course Payment Platforms:

- All-in-One Solution: Handles payment processing, subscriptions, and tax compliance in one platform.

- Global Compliance: Automatically manages VAT, sales tax, and other compliance requirements.

- Flexible Pricing Models: Supports subscriptions, one-time payments, and usage-based billing.

- Advanced Analytics: Provides in-depth insights into sales performance and customer behavior.

- Easy Integration: Works seamlessly with most SaaS platforms and custom setups.

Product Pros:

- Comprehensive solution with tax compliance

- Supports global sales

- Flexible pricing and billing options

- Advanced analytics and reporting

- Simplified integration process

Cons:

- Primarily geared towards SaaS and digital products

- Higher fees for certain features

User Experiences and Case Studies:

- SaaS Company: A software company offering online training integrated Paddle to manage global payments, reducing administrative costs by 30% due to automated tax handling.

- E-Learning Platform: An online education platform used Paddle’s subscription management to offer tiered pricing, increasing customer lifetime value by 15%.

- Digital Product Seller: A developer offering coding courses used Paddle to simplify international sales, boosting global revenue by 25%.

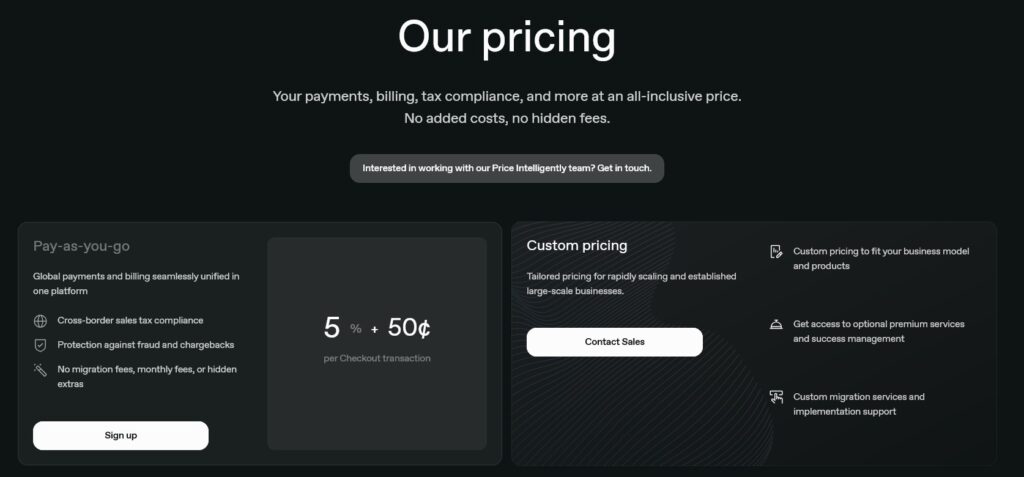

Pricing and Subscription:

- Revenue Share: 5% + 50¢ per transaction, with custom pricing available for high-volume merchants.

- Subscription Management: Included in the revenue share model, with no additional fees.

- Tax Compliance: No extra cost for handling VAT and sales tax.

How to Choose the Right Online Course Payment Platform for Your Business

Selecting the right Online Course Payment Platforms for your business depends on several factors, including your business size, course platform, budget, and specific needs.

Here’s a guide to help you make an informed decision:

- Business Size: Consider platforms that scale according to your business size. For small businesses, PayPal and Thinkific Payments offer affordable and easy-to-use features. Larger enterprises might benefit from more comprehensive solutions like Stripe or Paddle.

- Platform Integration: Ensure that the payment platform integrates seamlessly with your existing course platform, whether it’s Teachable, Thinkific, or a custom LMS.

- Budget: Evaluate the pricing plans of each platform. Determine whether the cost aligns with your budget while offering the necessary features.

- Specific Needs: Identify the key features that are most critical for your business. Whether it’s advanced tax handling, multi-currency support, or subscription management, ensure the platform you choose excels in those areas.

Benefits and Challenges of Using Online Course Payment Platforms for Creators in 2025

Benefits:

- Secure Transactions: Online Course Payment Platforms offer robust security features, ensuring that both creators and students can process payments confidently.

- Global Reach: These platforms often support multiple currencies, allowing creators to reach a global audience without worrying about currency conversion issues.

- Integration with LMS: Many platforms integrate seamlessly with popular LMS tools, automating the process of granting course access after payment.

- Flexible Pricing Models: Creators can set up one-time payments, subscriptions, or even offer payment plans, catering to different student needs.

- Automated Payouts: Platforms like Teachable Payments offer automated payouts, reducing the administrative burden on creators.

Challenges:

- Transaction Fees: Most Online Course Payment Platforms charge fees per transaction, which can add up, especially for high-volume sales.

- Complexity of Setup: Some platforms, like Stripe, may require technical knowledge for setup, making it challenging for creators without a technical background.

- Limited Features in Basic Plans: Free or lower-tier plans often come with limited features, which might not meet the needs of more advanced users.

- Compliance and Tax Handling: Managing VAT and sales tax can be complex, particularly for international sales, unless the platform provides built-in compliance tools.

- Dependence on Platform: Relying heavily on one payment platform can be risky if the platform changes its policies or experiences downtime.

Compare the Pricing, Fees, and Integration Options Available

1. Stripe:

- Pricing: Pay-as-You-Go (2.9% + 30¢ per transaction)

- Fees: Additional fees for international cards and currency conversion

- Integration: Extensive API integration, suitable for custom LMS setups

2. PayPal:

- Pricing: Standard Fees (2.9% + 30¢ per transaction within the U.S.)

- Fees: Higher fees for international transactions

- Integration: Simple integration with most websites and platforms

3. Teachable Payments:

- Pricing: Available with Teachable plans (from $29/month)

- Fees: Transaction fees vary by plan (5% on Basic, 0% on Business)

- Integration: Built-in with Teachable, no additional setup required

4. Thinkific Payments:

- Pricing: Available with Thinkific plans (from $49/month)

- Fees: Transaction fees vary by plan (5% on Basic, 0% on Premier)

- Integration: Native integration with Thinkific platform

5. Paddle:

- Pricing: Revenue Share (5% + 50¢ per transaction)

- Fees: Includes tax compliance at no extra cost

- Integration: Easy integration with SaaS platforms

Analyze How Online Course Payment Platforms Are Evolving to Meet the Needs of Creators

1. AI-Driven Features: Platforms are integrating AI to automate tasks such as payment reminders, fraud detection, and personalized payment plans.

2. Enhanced Security: As online transactions grow, Online Course Payment Platforms are enhancing their security measures, including advanced encryption and multi-factor authentication.

3. Better Integration: There is a trend towards seamless integration with other e-learning tools, allowing for a more cohesive user experience.

4. Global Compliance: More platforms are offering built-in tools for handling global taxes, such as VAT and GST, simplifying international sales for creators.

5. Mobile Optimization: As mobile learning becomes more prevalent, payment platforms are optimizing their checkout processes for mobile users.

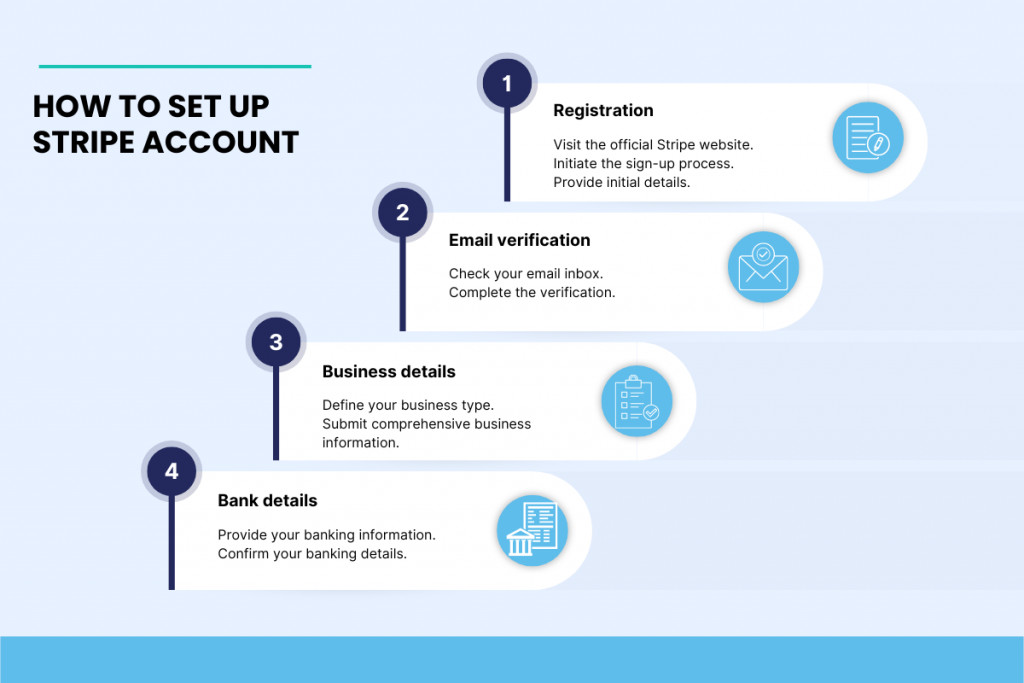

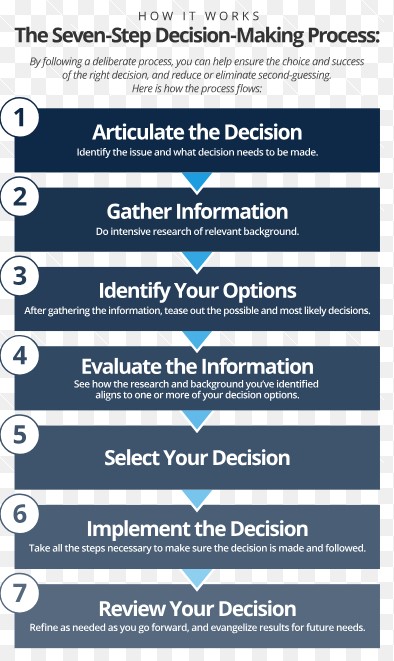

Provide a Step-by-Step Guide to Setting Up Payments for an Online Course

Step 1: Choose Your Platform

- Determine your needs (e.g., global reach, integration with LMS) and select the most suitable Online Course Payment Platform.

Step 2: Create an Account

- Sign up for an account on your chosen platform (e.g., Stripe, Teachable Payments).

Step 3: Set Up Payment Methods

- Link your bank account, enable credit card payments, and configure any additional payment methods.

Step 4: Integrate with Your LMS

- Use the platform’s API or direct integration features to connect with your LMS, ensuring seamless access after payment.

Step 5: Configure Pricing

- Set up your course pricing, including options for subscriptions, payment plans, or one-time payments.

Step 6: Test the Payment Process

- Conduct a test transaction to ensure everything works smoothly, from payment to course access.

Step 7: Go Live

- Once you’re confident in your setup, launch your course and begin accepting payments.

Offer Expert Tips on Maximizing Revenue Using the Payment Tools

1. Utilize Subscription Models:

- Offering subscription-based access can create a steady revenue stream rather than relying on one-time payments.

2. Offer Payment Plans:

- Provide students with the option to pay in installments, which can increase accessibility and enrollments.

3. Leverage Global Payments:

- Accept payments in multiple currencies to attract international students, thereby expanding your market.

4. Optimize Pricing:

- Experiment with different pricing strategies, such as tiered pricing or bundled courses, to see what resonates best with your audience.

5. Automate Reminders:

- Use the platform’s tools to send automatic payment reminders for subscriptions or overdue payments, ensuring consistent cash flow.

Provide a Case Study on a Creator Who Successfully Managed Payments Using a Top Platform

Case Study: The Success Story of an Online Yoga Instructor

Background:

A yoga instructor launched her online courses using Teachable Payments in early 2025. She faced challenges initially with pricing and international payments.

Implementation:

She utilized Teachable Payments for its built-in features, such as automated payouts and multi-currency support. By offering both one-time payments and subscription models, she was able to cater to a wider audience.

Results:

- Increased Enrollments: Within the first six months, her course enrollments increased by 30%, largely due to the flexibility in payment options.

- Global Reach: The multi-currency support allowed her to expand her student base to over 15 countries, significantly boosting her revenue.

- Efficient Management: The automated payout feature reduced her administrative workload, allowing her to focus more on content creation.

Takeaway:

The success of this instructor highlights the importance of choosing the right Online Course Payment Platform that offers flexibility, automation, and global reach.

Case Studies and Success Stories

Real-world examples of businesses that have successfully implemented Online Course Payment Platforms can provide valuable insights and inspiration.

Below are some notable success stories:

- Small Business: A digital marketing school integrated Stripe with their LMS, resulting in a 25% increase in student enrollment due to improved payment flexibility and security.

- Enterprise: A global e-learning platform used Paddle’s comprehensive solution to manage tax compliance and global payments, leading to a 30% reduction in administrative costs.

- Freelancer: A content creator offering online writing courses used PayPal to manage payments, benefiting from the platform’s invoicing and global reach, resulting in a 20% boost in course sales.

Best Practices for Using Online Course Payment Platforms

To maximize the effectiveness of your Online Course Payment Platforms, consider the following best practices:

- Secure Transactions: Ensure that the platform uses robust encryption and complies with industry standards for payment security to protect both your business and your customers.

- Payment Flexibility: Offer multiple payment options, including credit cards, PayPal, and direct bank transfers, to cater to a diverse audience.

- Regular Reporting: Use the platform’s reporting tools to monitor sales, track revenue, and analyze customer payment behavior. Adjust your pricing and marketing strategies based on these insights.

- Global Reach: Choose platforms that support multiple currencies and global payment methods to expand your reach to international students.

Common Mistakes to Avoid

When using Online Course Payment Platforms, it’s essential to avoid common pitfalls that could hinder your success:

- Ignoring Tax Compliance: Ensure that your payment platform handles VAT, sales tax, and other compliance requirements, especially if you’re selling internationally.

- Limited Payment Options: Don’t restrict your payment options to just one method. Offering multiple payment options can significantly increase your conversion rates.

- Overcomplicating Setup: Avoid overcomplicating the payment process with too many steps or integrations. Choose a platform that offers a straightforward setup and user experience.

FAQ Section (Online Course Payment Platforms)

Q1: What are Online Course Payment Platforms?

A: Online Course Payment Platforms are specialized tools designed to help educators and course creators accept payments for online courses. They offer features like secure transactions, multi-currency support, and integration with learning management systems (LMS).

Q2: Can an Online Course Payment Platform improve my course sales?

A: Yes, an Online Course Payment Platform can improve course sales by providing a smooth and secure payment experience. This makes it easier for students to pay, which can lead to increased enrollment and revenue.

Q3: Which Online Course Payment Platform is best for small businesses?

A: Thinkific Payments and PayPal are excellent Online Course Payment Platforms for small businesses due to their ease of use, affordability, and integration with popular course platforms.

Q4: What should I consider when choosing an Online Course Payment Platform?

A: When choosing an Online Course Payment Platform, consider its integration with your LMS, transaction fees, support for multiple currencies, and the specific payment features you need, such as subscription management or tax compliance.

Q5: Do Online Course Payment Platforms support global payments?

A: Yes, most Online Course Payment Platforms, like Stripe and Paddle, support payments in multiple currencies and regions, making them ideal for global course sales.